Beyond the budget 2022-23: Fiscal outlook and scenarios presents the Parliamentary Budget Office’s (PBO’s) independent projections for the Commonwealth’s fiscal position across the medium term (2026-27 to 2032-33). It also updates our analysis of long-term fiscal sustainability, to 2062-63.

Most of our medium-term projections show an improvement compared to our 2021-22 projections, published in September 2021, reflecting Australia’s recovery from the acute effects of the COVID-19 pandemic. Gross debt is projected to be lower as a percentage of GDP, and the underlying cash deficit is projected to be smaller across most of the medium term.

Despite these improvements, worsening economic conditions have added new challenges in recent months. High inflation, interest rate rises, and structural expenditure risks, such as ageing and climate change, are sources of fiscal pressure, all within the context of an uncertain global environment.

High inflation will increase revenue and social security and welfare expenses that are indexed to inflation. In addition, increased projected expenditure on the National Disability Insurance Scheme (NDIS), interest expenses on debt, and demand for aged care are expected to mostly offset the revenue increases across the medium term.

Current adverse economic conditions also have implications for the long-term budget position. Our fiscal sustainability analysis examines scenarios combining assumptions for economic growth, interest rates and the budget balance. These result in higher debt-to-GDP ratios compared to our 2021-22 analysis.

Nevertheless, the fiscal position remains sustainable in all but our most extreme scenarios. Governments will still need to act to ensure fiscal sustainability and periods of consolidation will be required. However, interventions need not deviate significantly from how such challenges have been met in the past.

The presentation of our independent medium-term projections, now in its 7th year, extends beyond the budget in both its level of detail for revenue and expenses as well as its long-term fiscal sustainability analysis.

Our projections are based on the policy settings, budget estimates, and economic parameters of the 2022-23 October Budget. We use this information to project from the end of the budget forward estimates to the end of the medium term, based on our own set of models and professional judgement.

Data for all charts and tables in this report are available from our Data portal. If you find this report useful or have suggestions for improvement, please provide feedback to feedback@pbo.gov.au.

1 How to read this report

Beyond the budget 2022-23: Fiscal outlook and scenarios presents the Parliamentary Budget Office’s (PBO’s) independent projections for the balance sheet, major fiscal aggregates, and revenue and expense categories across the medium term (2026-27 to 2032-33). It also includes our scenario analysis of Australia’s long-term fiscal sustainability to 2062-63.

The report presents our annual medium-term budget outlook based on the policy settings, budget estimates, and economic parameters of the most recent Australian Government budget, as well as how the outlook has changed from our previous update. The medium-term projections presented here are based on the 2022-23 October Budget. Comparisons are made to our Beyond the budget 2021-22, released in September 2021 and based on the 2021-22 Budget.

The long-term fiscal sustainability analysis presented here is also based on the fiscal settings of the 2022-23 October Budget. It considers how the balance sheet could evolve after the end of the medium term (from 2033-34 onwards). Broadly, it explores the question: ‘If governments maintain budget balances that are similar to historical precents, is the fiscal position likely to be sustainable across the long term?’. To answer this, we focus on potential pathways for the debt-to-GDP ratio from 2033-34 to 2062-63, based on combinations of 3 key parameters: a budget balance (headline cash balance before interest payments), interest rates, and economic growth (nominal GDP).

As our framework for fiscal sustainability centres on the balance sheet, we present our medium-term outlook for the balance sheet and major aggregates first, followed by our long-term fiscal sustainability scenarios, and finally more detail on government revenue and expenses across the medium term. For more information on our projection methodology, see Appendix A.

As a companion to this report, we also provide the underlying data series for all charts and tables, available from our Data portal.

2 Balance sheet and major fiscal aggregates

- This chapter presents our medium-term projections for the balance sheet and major fiscal aggregates.

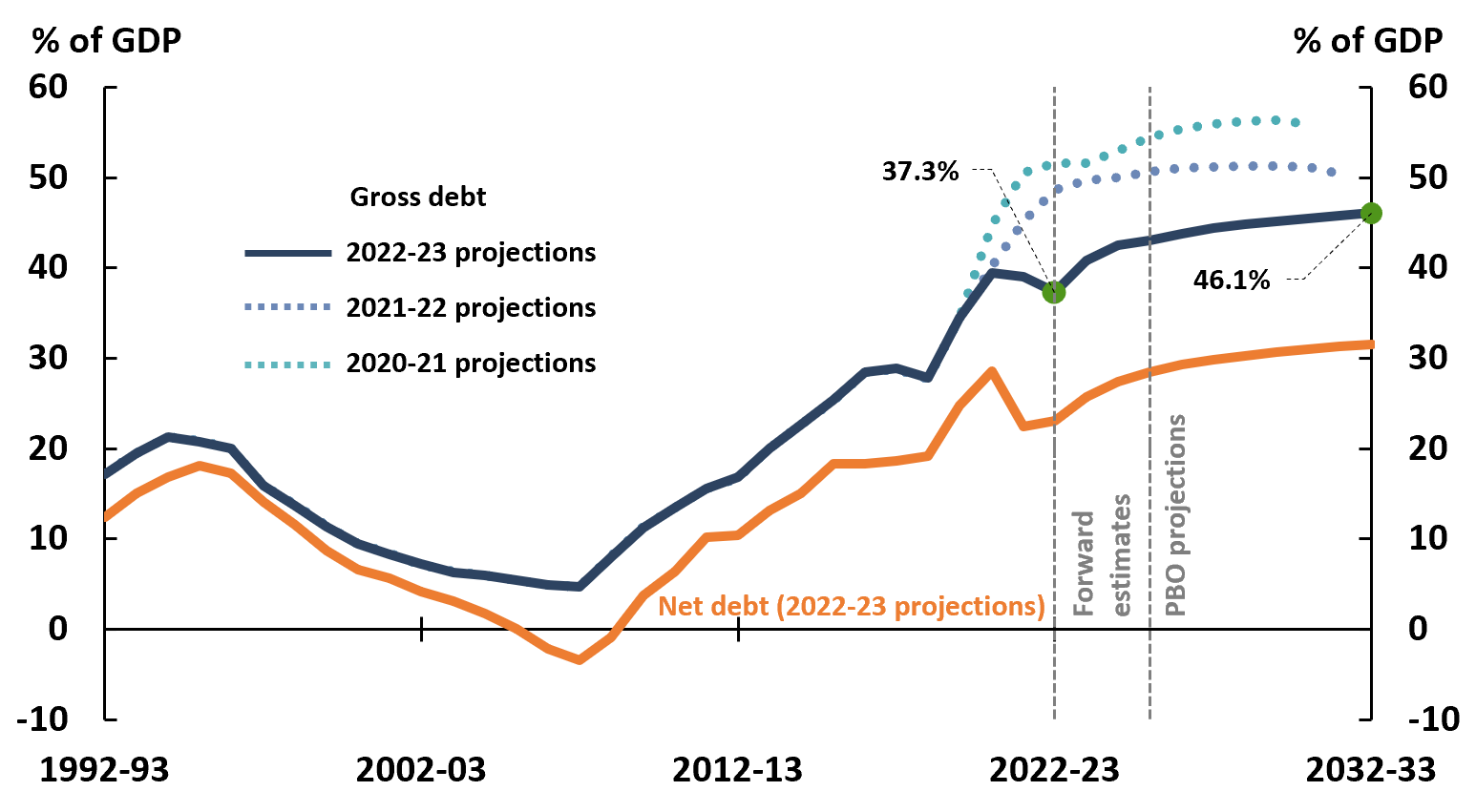

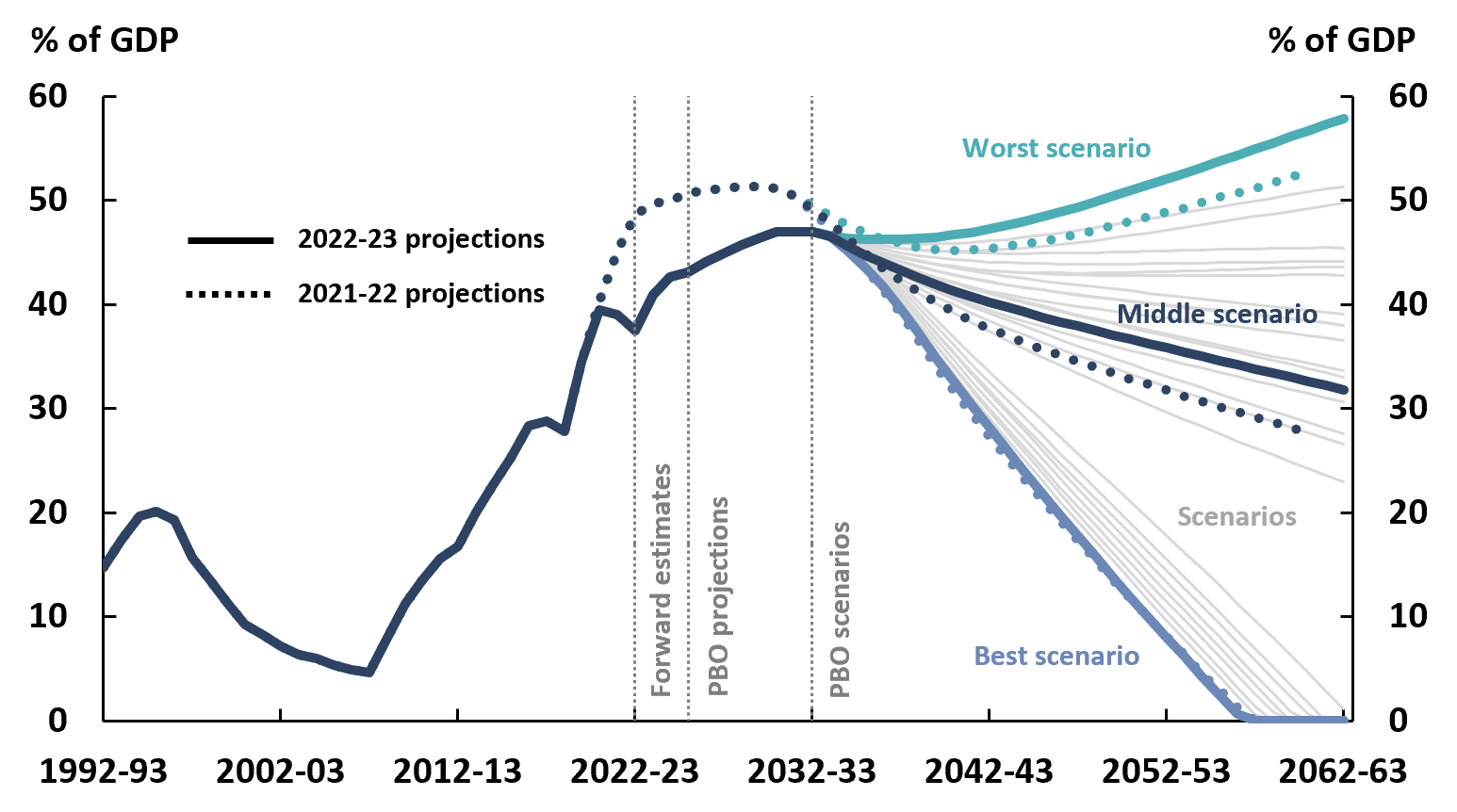

- Gross debt is projected to rise from 37.3% of GDP in 2022-23 to 46.1% of GDP in 2032-33, driven by continued budget deficits.

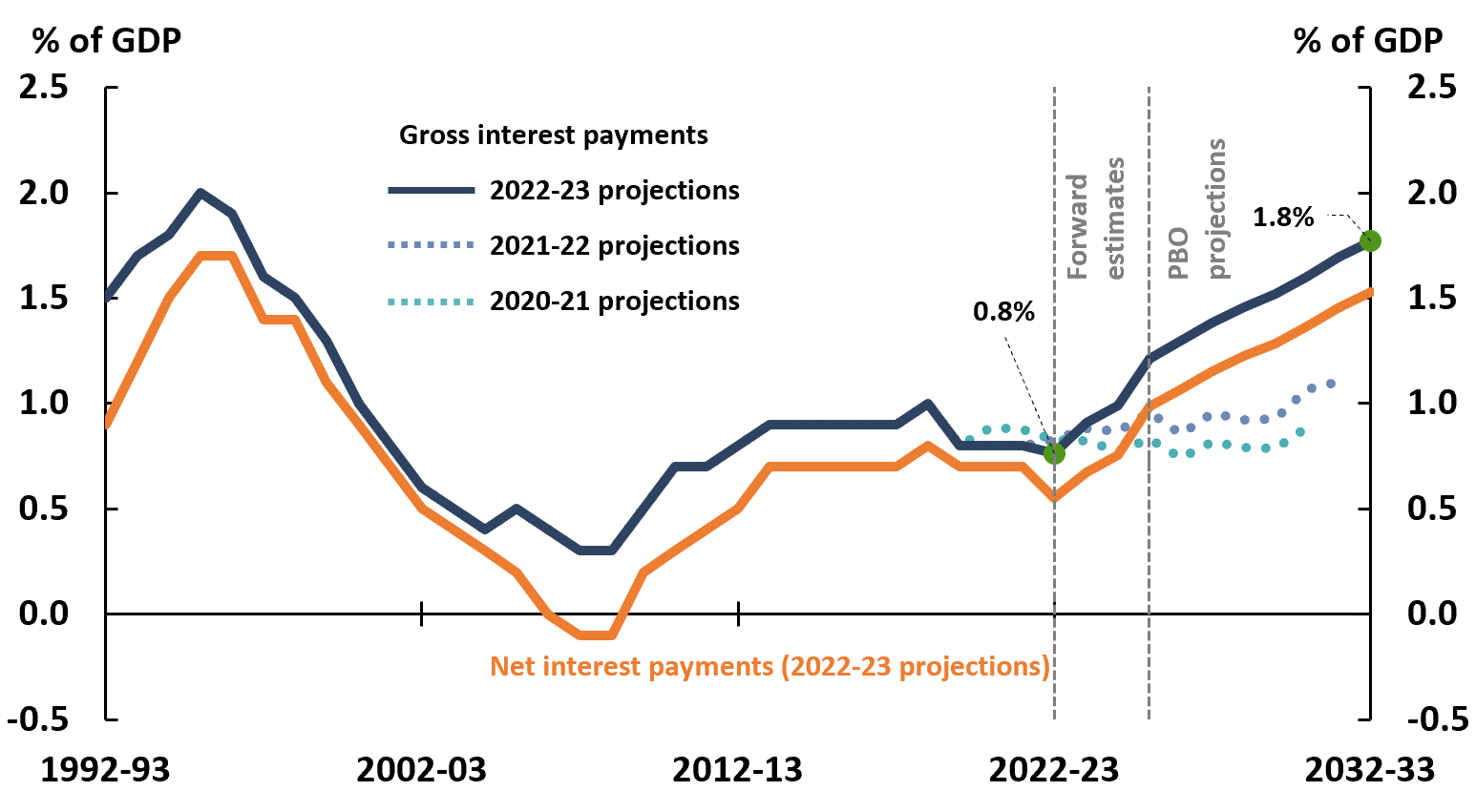

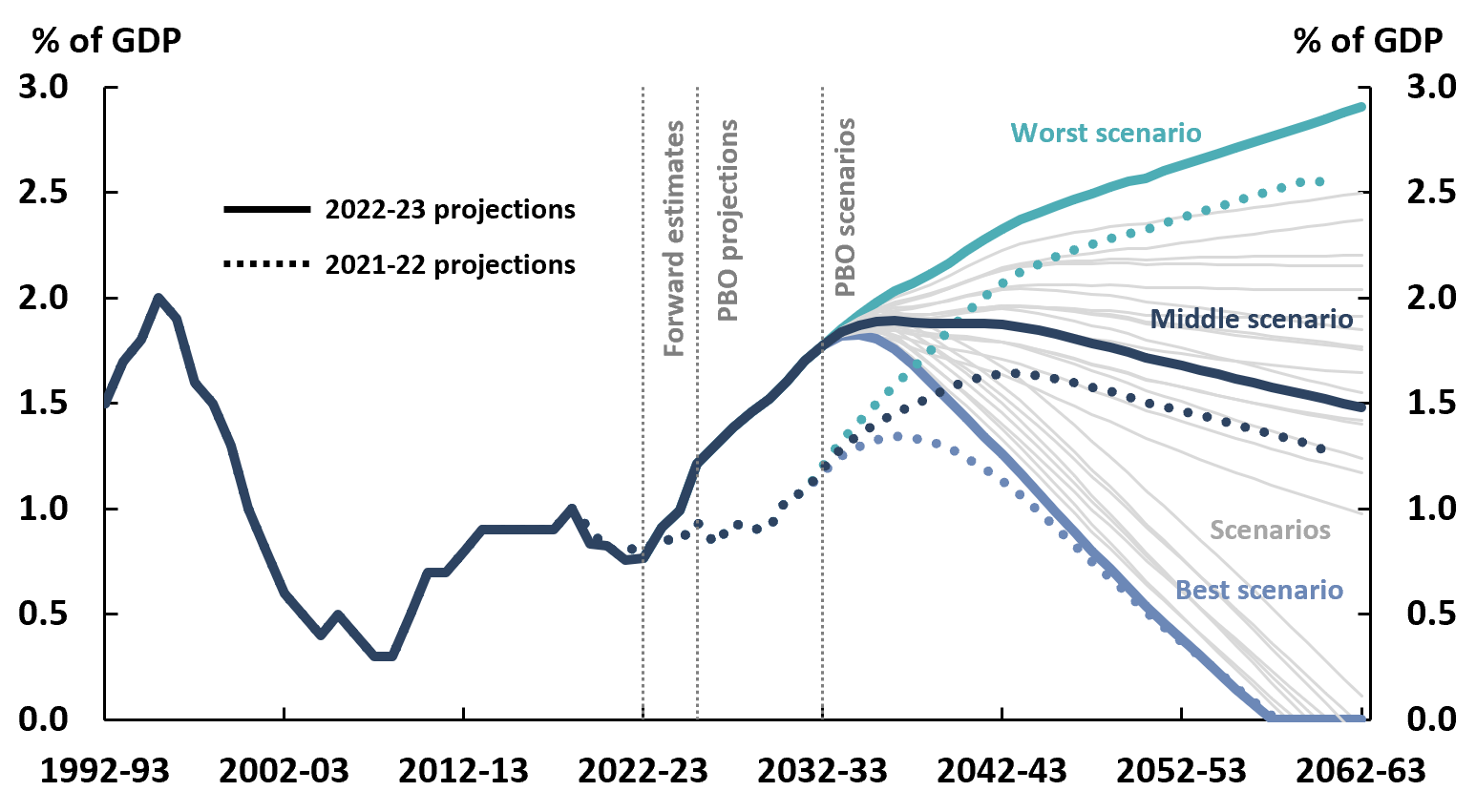

- Gross interest payments are projected to more than double as bond yields rise, increasing from 0.8% of GDP in 2022-23 to 1.8% of GDP in 2032-33.

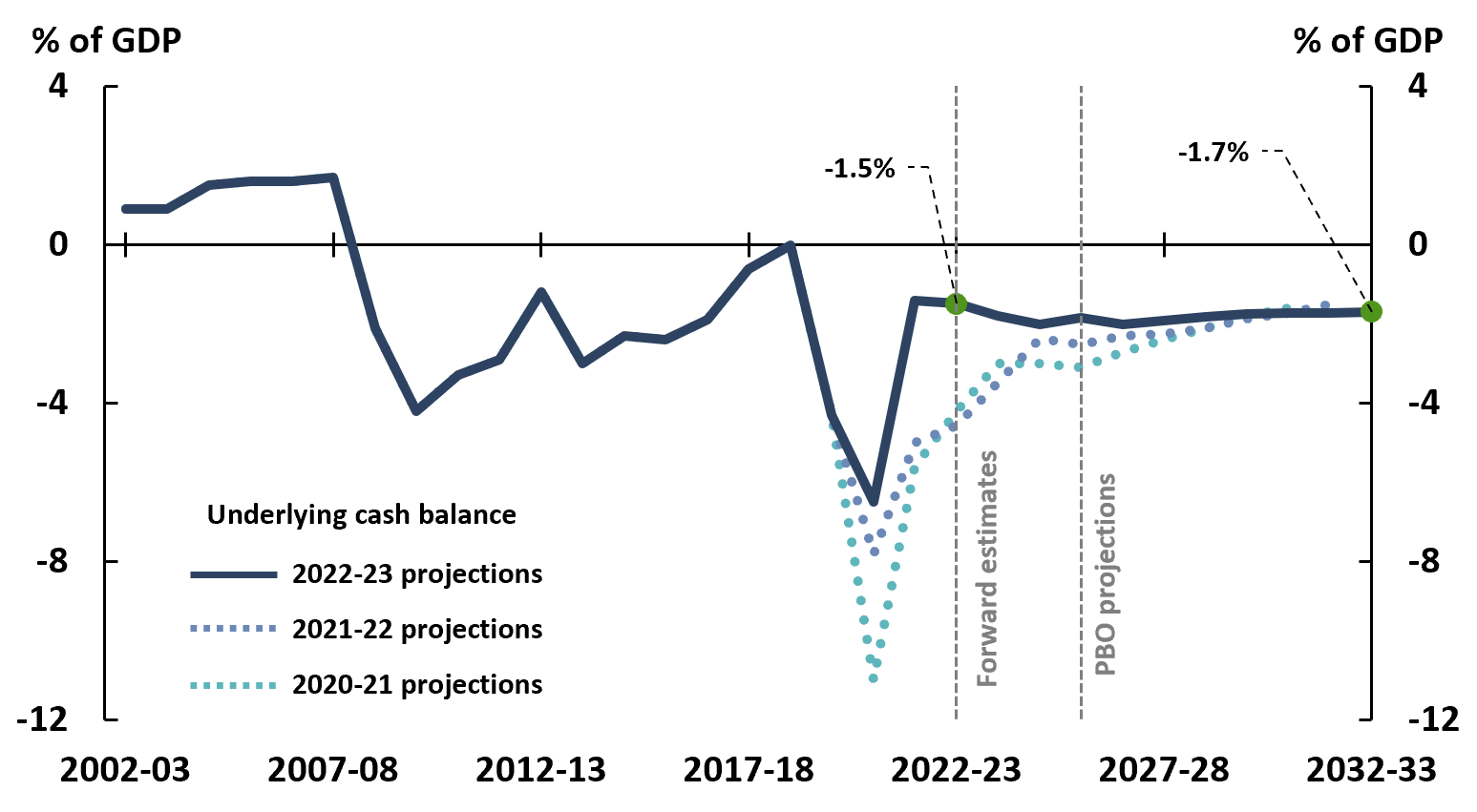

- The underlying cash deficit is projected to increase slightly from 1.5% of GDP in 2022-23 to 1.7% of GDP in 2032-33, with increased payments offsetting higher receipts.

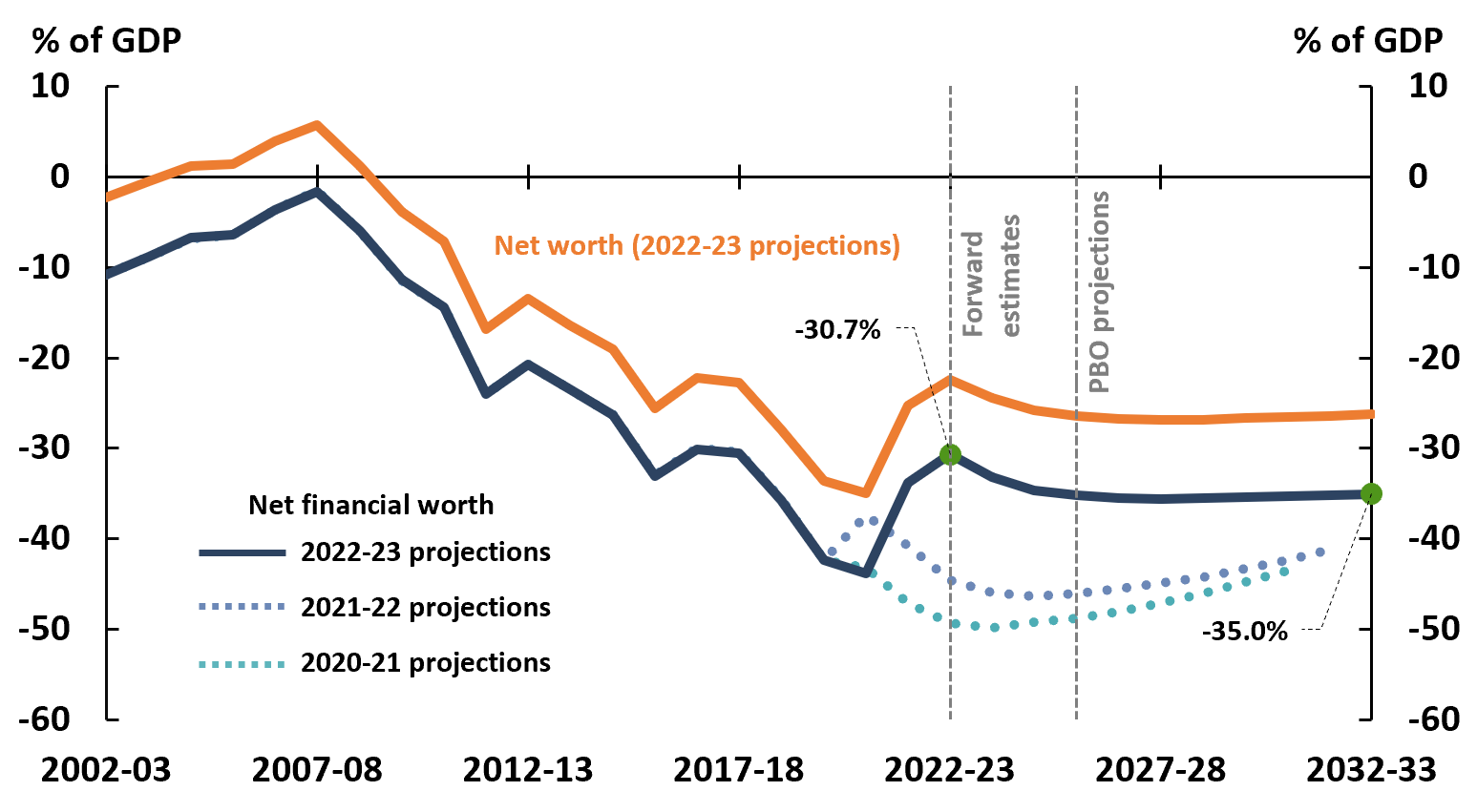

- Net financial worth is projected to decrease from -30.7% of GDP in 2022-23 to -35.0% of GDP in 2032-33, reflecting the outlook for debt.

Gross debt (Figure 2-1) is projected to rise over the medium term as a percentage of GDP but to a lower level than our previous projections.1 The improvement is largely due to smaller forecast budget deficits across the budget’s forward estimates.

| Figure 2-1: Gross and net debt, 1992-93 to 2032-33 |

|

Note: 2020-21 and 2021-22 projections refer to the PBO’s previous Beyond the budget and Medium-term fiscal projections reports. |

Source: 2020-21 Budget, 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

Previously, gross debt was projected to peak in 2028-29 and then decrease towards the end of the medium term. Now, gross debt is projected to rise steadily through to 2032-33, largely driven by the costs to deliver the National Disability Insurance Scheme (NDIS) and higher interest payments on debt (see Chapter 5).

Despite the improvement across the medium term, the changed trajectory for debt has worsened the long-term outlook (2033-34 to 2062-63). In our fiscal sustainability analysis (see Chapter 3), the debt-to-GDP ratio is expected to be higher in most of our long-term scenarios compared to our 2021-22 analysis.

Net debt, which adjusts the value of gross debt to account for the government’s financial assets, is projected to follow a similar trajectory to gross debt and is lower in 2031-32 compared to our 2021-22 projections.

The outlook for net debt is driven by the same factors that affect gross debt, as well as decreases in the market value of Australian Government Securities (AGS).2 This is because gross debt is calculated on the face value of AGS, while net debt is calculated on the market value of AGS.

Gross and net interest payments (Figure 2-2) are projected to rise significantly over the medium term as a percentage of GDP, more than doubling from their 2022-23 level. By 2032-33, gross interest payments are projected to reach their highest level since 1997-98.

| Figure 2-2: Gross and net interest payments, 1992-93 to 2032-33 |

|

Note: Interest receipts, such as earnings on the government’s Future Fund, are subtracted from gross interest payments in the calculation of net interest payments. Interest receipts are also projected to increase across the period 2022-23 to 2032-33. |

Source: 2020-21 Budget, 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

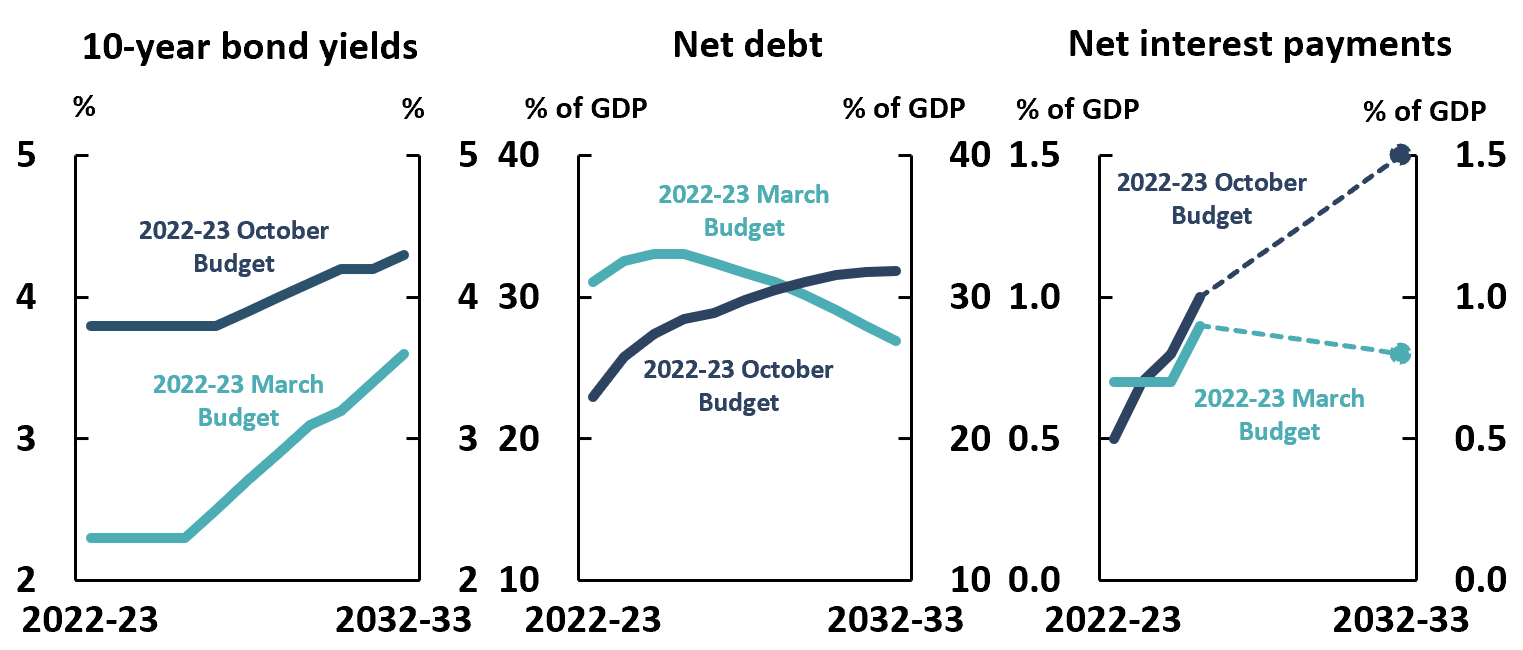

From May to October 2022, the Reserve Bank of Australia (RBA) raised its overnight cash rate target from 0.1% to 2.6% to address inflationary pressures (see Box 2-1).3 As a result, expected yields on government bonds were revised upwards significantly between the 2022-23 March Budget and the 2022-23 October Budget.

|

Box 2-1: The impact of inflation on the budget Between the 2022 Pre-election Economic and Fiscal Outlook (PEFO) and the 2022-23 October Budget, the economic outlook changed markedly. Inflation had increased and interest rates were raised sooner than previously expected. Both factors were expected to impact the budget over the coming years. Inflation can affect the budget both positively and negatively. Inflation can increase government revenue as incomes rise. Personal income tax revenue increases because of bracket creep, while higher household consumption (in nominal terms) increases revenue from consumption taxes, such as the goods and services tax (GST). However, inflation also increases government expenses, such as social security and welfare payments that are indexed to the consumer price index (the CPI) or wages. Nominal income growth can also place upwards pressure on salary and wage expenses for the government. For example, in the 2022-23 October Budget, ‘parameter and other variations’4 increased revenue estimates by $148.8 billion over the forward estimates, partially offset by higher expenses of $98.5 billion over the same period. While inflation can have a net positive impact on the budget, there are economic costs to excessive inflation. Inflation increases business costs, which can decrease company tax revenue if price increases are not passed onto consumers. Lower profits may also cause businesses to employ fewer people, reducing personal income and consumption tax revenues. These factors can offset improvements. The Reserve Bank of Australia (RBA), which is responsible for the formulation of monetary policy, can increase interest rates (by increasing its overnight cash rate target) to address inflationary pressures. Higher interest rates increase the costs of borrowing, which can reduce business investment and household consumption. The intended effect is to slow aggregate demand and dampen the inflation rate, though the effects of monetary policy usually take some time to flow through to economic activity.5 Interest rate rises also increase the costs of servicing government debt. This is because, as interest rates rise, yields on government bonds adjust to meet prevailing market conditions. As a result, when the government issues new bonds to finance future budget deficits or refinance matured debt, it must pay a higher rate of interest. Higher interest payments can also have implications for fiscal sustainability. Generally, if the budget is in deficit and the average interest rate on the stock of debt exceeds the rate of economic growth, the debt-to-GDP ratio will increase (see Box 3 of our Fiscal sustainability report). If the debt-to-GDP ratio trends upwards over the long term, this may mean that major and unfamiliar interventions are required to reduce budget deficits and keep debt broadly stable as a percentage of GDP (see Chapter 3). |

The 2022-23 March Budget assumed a weighted average cost of borrowing of 2.2% across the forward estimates (2022-23 to 2025-26), while the 2022-23 October Budget assumed a weighted average cost of 3.8% across the same period.6 The 2021-22 Budget assumed a weighted cost of only 1.6% across the 2021-22 forward estimates (2021-22 to 2024-25).7

The significant increase in interest payments compared to our 2021-22 projections reflects the upwards revision to expected bond yields, as debt issued from 2022-23 onwards (including refinancing matured debt) is expected to have a higher cost to service than the existing stock of debt.

Figure 2-3 shows the effect of bond yields on interest payments by comparing projections from the 2022-23 March Budget and the 2022-23 October Budget. This helps illustrate why our projections for interest payments are so much higher than our 2021-22 projections (Figure 2-2), even with an improved outlook for debt.

| Figure 2-3: 2022-23 Budgets – bond yields, net debt, and net interest payments |

|

Source: 2022-23 March Budget, 2022-23 October Budget, and PBO analysis. |

The underlying cash deficit (Figure 2-4) is projected to increase slightly as a percentage of GDP across the medium term. Compared to our 2021-22 projections, the underlying cash deficit is forecast to be significantly smaller across the forward estimates, though it is projected to be around the same level by 2031-32.

The upwards revision across the forward estimates largely reflects the stronger final budget outcome for 2021-22 than was forecast as well as changes in economic conditions reflected in the 2022-23 October Budget. Higher personal income tax receipts, driven by higher inflation and nominal income growth, contributed the most to the improvement.

However, the improvement does not continue across the medium term. By 2032-33, the underlying cash deficit is projected to remain largely unchanged from our previous projections. This largely reflects the costs to deliver the National Disability Insurance Scheme (NDIS), interest payments on debt, and increased demand for aged care (see Chapter 5).

The flatter trajectory for the underlying cash deficit also reflects the change in the assumption for long-run productivity growth in the 2022-23 October Budget, which was revised downwards to 1.2% from 1.5% in previous budgets and the 2021 Intergenerational Report. This has the effect of reducing long-run GDP growth and hence tax receipts.8

|

Box 2-2: Election commitments in the 2022-23 October Budget The Parliamentary Budget Office is required to publish a report after each general election that details and aggregates the budget impacts of election commitments made by the major political parties, known as our Election commitments report (ECR). Our ECR assists the Parliament and the Australian public by creating a record of commitments made during an election and their impact on the budget. The 2022-23 October Budget was the first opportunity for the new government to implement its election commitments following its win at the 2022 federal election. Of the 154 commitments made by the Australian Labor Party (ALP) and recorded in our ECR, 148 (96%) were explicitly reflected in budget measures, though with various modifications.9 Only a small number of the ALP’s election commitments were not readily identifiable in the budget papers. These included commitments related to permanent visa changes and temporary skilled migration. Although these commitments were not explicitly referenced in the budget papers, the government has made some subsequent announcements, including establishing a review of the migration system.10 See our 2022 Election commitments report for more information. |

| Figure 2-4: Underlying cash balance, 2002-03 to 2032-33 |

|

Source: 2020-21 Budget, 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

Policy decisions in the 2022-23 October Budget were estimated to worsen the underlying cash balance by $9.8 billion across the forward estimates relative to the 2022 Pre-election Economic and Fiscal Outlook (PEFO) (See Box 2-2).11

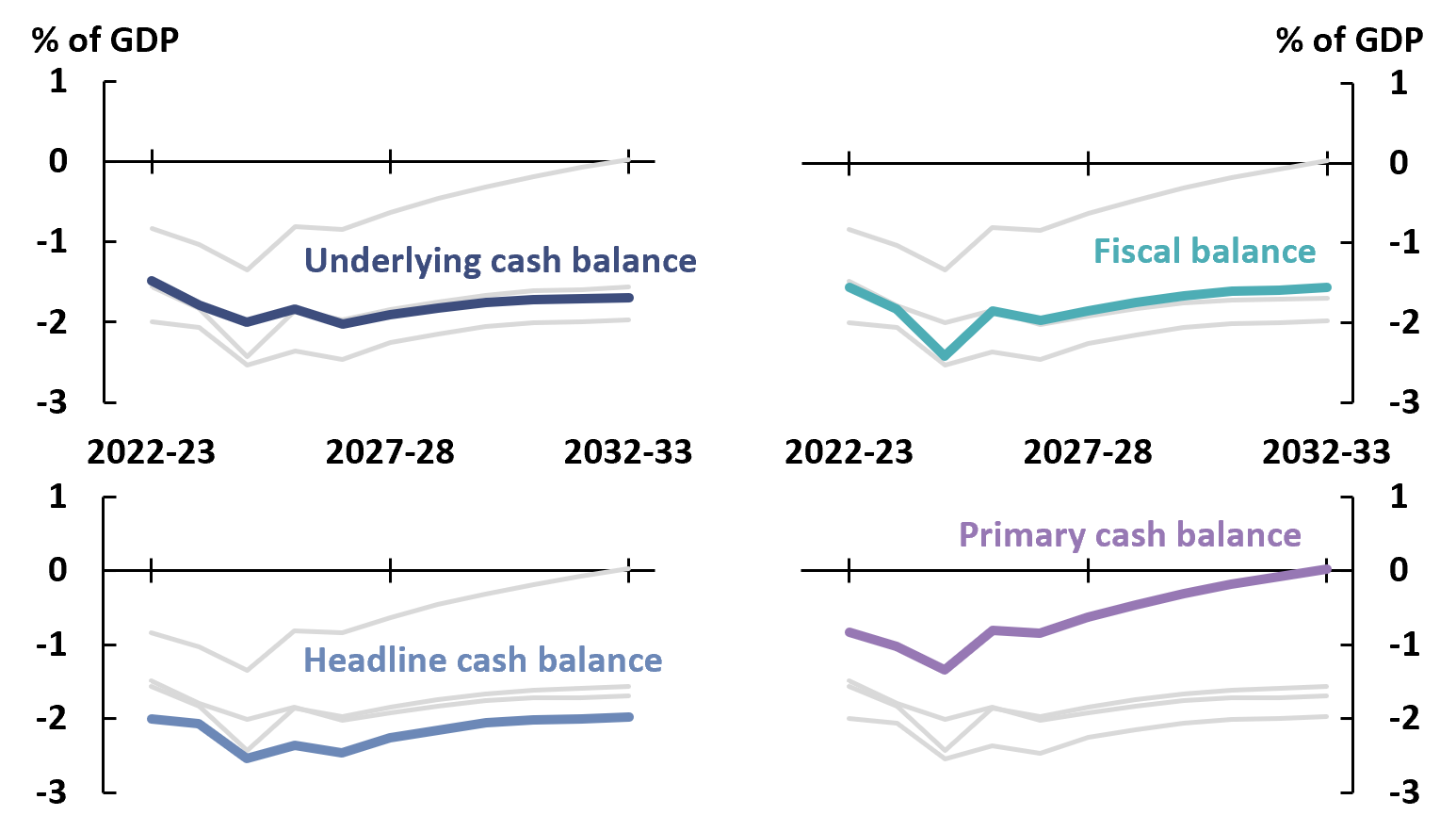

The underlying cash balance is one of several ‘fiscal aggregates’ used to assess the budget position. As each aggregate has a different focus, it can be useful to examine different aggregates when assessing the budget position.

The fiscal balance, headline cash balance, and primary cash balance (see Box 2-3) are commonly used in conjunction with the underlying cash balance.

- The fiscal balance is projected to be slightly lower than the underlying cash balance in 2032-33. The fiscal balance typically leads the underlying cash balance, but both aggregates tend to follow the same trajectory.

- Compared to the other measures, the headline cash balance is projected to be in the largest deficit across the medium term. The difference largely reflects measures that have a negative impact on the headline cash balance but little impact on other indicators of the budget balance, such as student loans and equity injections.

- The primary cash balance, which subtracts net interest payments from the underlying cash balance, is the only aggregate projected to return to surplus before 2032-33. This suggests that, as improvements are made to the fiscal and underlying cash balances, the improvements are eroded by higher interest payments.

Figure 2-5 compares the underlying cash balance, fiscal balance, headline cash balance, and primary cash balance. Each quadrant highlights a different balance.

| Figure 2-5: Budget aggregates, 2022-23 to 2032-33 |

|

Note: Grey lines represent the 3 indicators not separately identified. For example, from top to bottom, the grey lines on the top left quadrant are the primary cash balance, fiscal balance, and headline cash balance respectively. |

Source: 2022-23 October Budget and PBO analysis. |

Net financial worth and net worth (Figure 2-6) are projected to decrease as a percentage of GDP across the medium term, largely due by the same factors that affect net debt.

| Figure 2-6: Net financial worth and net worth, 2002-03 to 2032-33 |

|

Source: 2020-21 Budget, 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

|

Box 2-3: Bridging the balances The net operating balance, fiscal balance, headline cash balance, and primary cash balance are common aggregates used in conjunction with the underlying cash balance to examine the budget position.

In our fiscal sustainability analysis (Chapter 3), we focus on the HCB before interest payments as the relevant ‘budget balance’. Interest payments are modelled separately to assess the impacts of interest rates on the debt-to-GDP ratio. For further information, see our Online budget glossary. |

3 Fiscal sustainability

- This chapter explores how the balance sheet could evolve under a range of assumptions and whether the fiscal position is likely to be sustainable over the long term to 2062-63.

- Our scenarios show that the longer-term fiscal position is weaker than our 2021-22 analysis suggested, with the long-term debt-to-GDP ratio higher in most scenarios, reflecting continued budget deficits and higher interest payments on debt.

- The fiscal position is sustainable in most scenarios. This means that future governments should be able to keep debt-to-GDP relatively stable through interventions on a similar scale to what we have seen in the past.

- However, there are structural risks to the budget, including the ageing population and the climate change transition, that may increase the extent to which governments would need to intervene to keep the fiscal position sustainable.

Judgements about fiscal sustainability relate to the very long term. In this analysis, fiscal sustainability refers to the government’s ability to maintain its long-term fiscal policy settings indefinitely without the need for major remedial policy interventions. This generally means that the government’s historical approach to borrowing and repaying debt can be continued while keeping taxation and spending within reasonable and expected bounds.

Based on this criterion, we consider that the fiscal position is likely to be sustainable if the debt-to-GDP ratio is expected to be broadly stable or trending downwards over the long term. Such circumstances would allow governments to pursue their long-term policy objectives and support sustainable economic growth. It would also allow for flexibility in the budget for governments to respond to changes in economic conditions, including downturns, either through automatic or discretionary mechanisms.

A sustainable position does not mean the debt-to-GDP ratio will not increase at times, especially in response to large unforeseen economic shocks, such as the COVID-19 pandemic. In this sense, it is not necessarily the level of debt that determines if the fiscal position is stable, but whether, on average, the debt-to-GDP ratio is expected to remain stable or trend downwards over the long term.

By comparison, the fiscal position may not be sustainable if the debt-to-GDP ratio is expected to trend upwards over the long term. In such circumstances, major interventions could be needed to reduce deficits and keep debt broadly stable as a percentage of GDP.

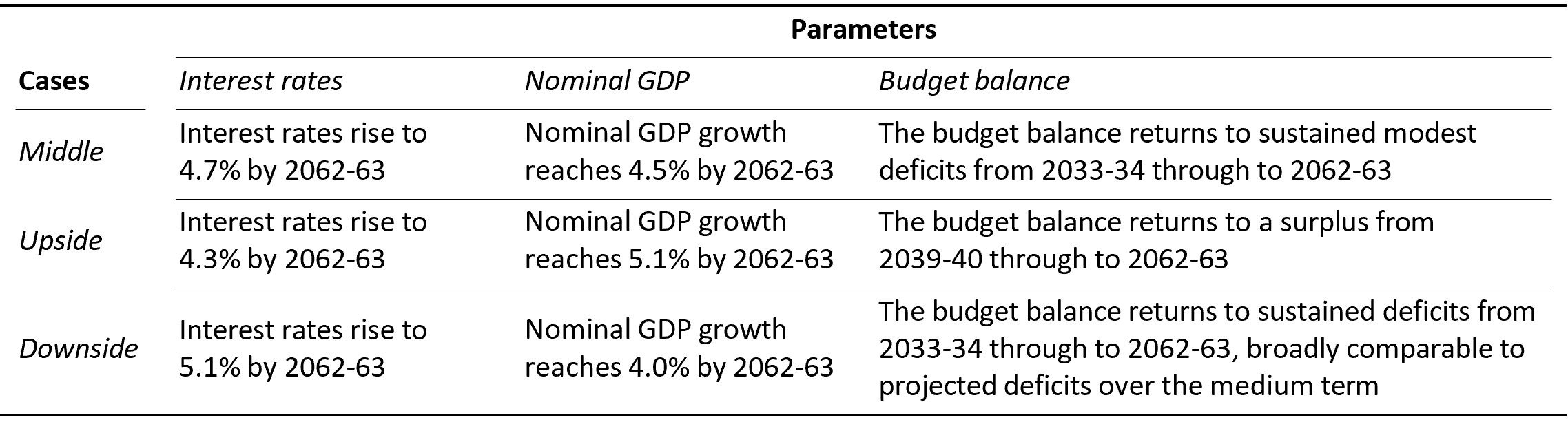

he long-run trajectory for the debt-to-GDP ratio is driven by 3 parameters: the budget balance (headline cash balance before interest payments), interest rates on the stock of debt, and economic growth (nominal GDP).

In our fiscal sustainability analysis, we examine 27 possible scenarios for the debt-to-GDP ratio over the next 40 years. Each scenario reflects variations in the 3 parameters identified above, consistent with low, middle, and high ranges throughout history. Here, we refer to these variations as ‘cases’. For example, one scenario might combine our middle case for the budget balance, our upside case for interest rates, and our downside case for GDP growth. Our cases for the budget balance, interest rates, and economic growth are described below.

Interest rates rise significantly from their recent historical lows in all scenarios.

- In our middle case, interest rates rise to 4.7% by 2062-63, reflecting assumptions for long-term bond yields.

- In our upside and downside cases, interest rates reach ±0.4 percentage points (ppt) from our middle case by 2062-63.

Our GDP scenarios incorporate different paths for important drivers of growth.

- Future economic growth depends on growth in the population, productivity, and labour force participation.

- For variables that may vary significantly over time, such as productivity, we implicitly account for peaks and troughs by looking at their long-run historical averages.12 For population growth, which incorporates the impact of ageing, we take projections from the Australian Bureau of Statistics.13

- In our middle case, nominal GDP growth reaches 4.5% by 2062-63. In our upside and downside cases, GDP growth reaches approximately ±0.6 ppt from our middle case by 2062-63, which reflect deviations in both productivity and population growth.

The budget balance remains in deficit in most scenarios, reflecting the historical precedents.

- In our middle case, the budget balance returns to sustained, modest deficits from 2033-34 through to 2062-63, which reflect the long-term historical average.

- Our downside case considers a sustained larger deficit from 2033-34 to 2062-63, broadly comparable to the projected deficits over the medium term.

- The upside case assumes a gradual return to a small surplus from 2039-40 through to 2062-63.

Each of our scenarios represent a possible future trajectory for the debt-to-GDP ratio, but we do not make any judgement as to which scenario is most likely. For instance, our ‘middle’ scenario should not be considered as a baseline or most likely trajectory. Instead, we are illustrating what the path could be under a range of plausible economic and policy conditions.

Importantly, the best and worst scenarios represent combinations of interest rates and economic growth that would be unlikely to persist for an extended period of time. For example, should economic growth slow to the rate assumed in the worst scenario, the Reserve Bank of Australia would likely respond by lowering interest rates, offsetting the impacts on the budget balance.

By building our scenarios around historical averages, we have implicitly captured the impact of future economic shocks and policy changes, to the extent that these are of a similar magnitude to those of the past. However, if future economic shocks were larger or more frequent than historical shocks, or if long-term structural shifts meant that GDP growth rates were much lower than they have been historically, this would make it more difficult for Australia to maintain a fiscally sustainable position.

Some structural shifts may be largely predictable, such as the impact of the ageing population, but there may also be shifts or shocks that are highly uncertain, such as those relating to climate change.

While some policies to reduce emissions may reduce productivity in a way that can be anticipated, the frequency and impact of extreme weather events due to climate change is much harder to predict. Our upside and downside scenarios aim to capture some of this uncertainty.

For more information on the framework that we use to assess fiscal sustainability, see our Fiscal sustainability report. Our Fiscal sustainability dashboard can be used to explore further our 27 long-term scenarios.

Table 3-1 shows our middle, upside, and downside cases. The results of all 27 scenarios are shown in Figure 3-1. Interest payments under each scenario are shown in Figure 3-2.

| Table 3-1: Cases for middle, best and worst scenarios 14 |

|

In 24 of our 27 long-term scenarios, the debt-to-GDP ratio is expected to be stable or trending downwards by 2062-63. This suggests that the fiscal position is likely to be sustainable except for in the most extreme circumstances.

| Figure 3-1: Gross debt, 1992-93 to 2062-63 |

|

Source: 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

| Figure 3-2: Interest payments, 1992-93 to 2062-63 |

|

Source: 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

In our middle scenario, the debt-to-GDP ratio is projected to peak in 2032-33 and then trend downwards until the end of the scenario period. Compared to the middle scenario in our 2021-22 analysis, the downwards trajectory is slower, and the debt-to-GDP ratio is higher in 2061-62. This pattern primarily reflects budget deficits across the medium term, flowing across the scenario period. Interest payments follow a similar trajectory to the debt-to-GDP ratio but are considerably higher than the middle scenario in our 2021-22 analysis, reflecting recent interest rate rises.

In our best scenario, characterised by historically high GDP growth, low interest rates, and budget surpluses from 2041-42 onwards, the debt-to-GDP ratio trends downwards from 2032-33 and reaches nil by 2057-58. Interest payments also reach nil by 2057-58, reflecting the elimination of debt, though from a higher peak compared to our 2021-22 analysis.

In our worst scenario, the debt-to-GDP ratio trends upwards over the scenario period, though it remains relatively flat between 2032-33 and 2042-43. This scenario is characterised by adverse economic conditions, with lower GDP growth and higher interest rates, matched by the government continuing to run large deficits. The temporary flattening after 2032-33 reflects that most of the debt accumulated before 2022-23 was issued at historically low interest rates. Interest payments continue to increase even when the debt-to-GDP ratio is broadly stable and are much higher than our worst scenario in our 2021-22 analysis, again reflecting interest rate rises.

In 3 of our 27 scenarios, the debt-to-GDP ratio trends upwards over the long-term. These 3 scenarios all assume that the budget balance and at least one other key parameter – interest rates or GDP growth – remain at historically unfavourable levels. If governments continue running budget deficits at the level expected over the medium term for a longer period, the fiscal position would only be sustainable with favourable economic conditions in terms of GDP growth and interest rates. In a scenario where GDP growth is persistently low and interest rates remain higher than expected, this would require more fiscal policy intervention from governments to keep the debt-to-GDP ratio stable.

Each scenario is based on historical averages, which means they implicitly incorporate the peaks and troughs of economic cycles. For instance, periods of weaker GDP growth are balanced by periods of stronger growth, and periods of large budget deficits are offset by periods of smaller deficits or surpluses. While we do not explicitly model economic shocks, such as those caused by financial crises, pandemics or climate change, our downside scenarios may be thought of as those in which such events are occurring more frequently than suggested by the long-term historic experience.

Concerted efforts to build fiscal buffers (that is, to lower the level of debt) can provide more flexibility to governments when responding to such events. Medium-term fiscal strategies are a key tool in building fiscal buffers and managing fiscal policy expectations. They can effectively extend the horizon for fiscal policy beyond the forward estimates and into the medium term, promoting fiscal discipline and accountability. They underpin a strategy, that should unforeseen events come to pass, governments would take action to ensure fiscal sustainability (see Box 3-1).

Importantly, future governments would need to take fiscal policy actions to ensure sustainability in all scenarios, including those assessed as sustainable. A fiscally sustainable position does not mean governments do not need to address structural budget issues or to repair the budget after a downturn, but rather that the magnitude of fiscal policy interventions would be comparable to examples previously seen in Australia. The longer that governments wait to address structural issues, the larger the policy change required to keep the fiscal position sustainable.

|

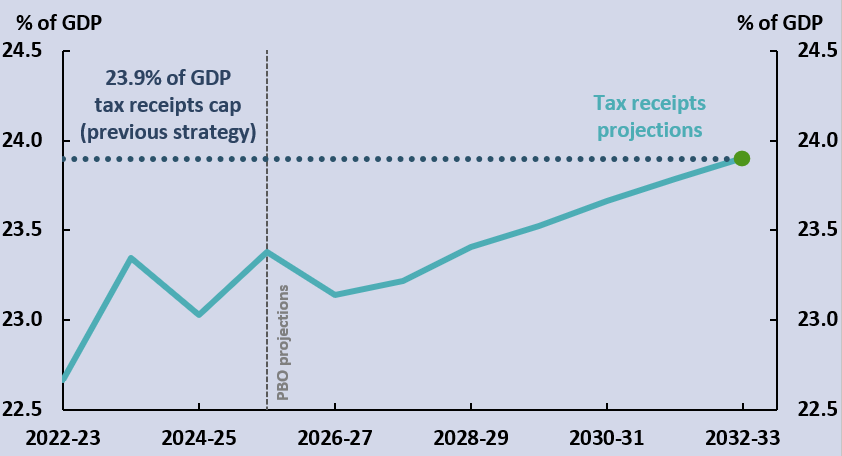

Box 3-1: Changes to the government’s fiscal strategy Our Beyond the budget: Fiscal outlook and scenarios reports are based on the policy settings, economic parameters, and budget outcomes of the most recent Australian Government budget. Changes to the government’s fiscal strategy, as outlined in the budget, have a direct effect on our medium-term projections and fiscal-sustainability analysis. In both the 2022-23 March Budget and the 2022-23 October Budget, fiscal strategy was centred around economic growth, budget repair, and reducing the debt-to-GDP ratio across the medium term. However, there were changes in the wording as to how these commitments would be achieved. The 2022-23 March Budget targeted “a budget balance, on average, over the course of the economic cycle that is consistent with the debt objective”.15 This explicit reference to the budget balance was removed from the 2022-23 October Budget, though it included a commitment to “limit growth in spending until gross debt as a share of GDP is on a downwards trajectory”.16 The budget balance does not necessarily need to be zero or in a surplus to reduce the debt-to-GDP ratio. This is seen in our middle case for the budget balance (Table 3-1), where modest deficits are assumed from 2033-34 to 2062-63. Generally, if there is a small budget deficit and the rate of economic growth exceeds the rate of interest on debt, debt-to-GDP can be maintained at a broadly stable level (see Box 3 of our Fiscal sustainability report for more information). Accordingly, budget deficits can be consistent with a fiscally sustainable position. The 2022-23 March Budget strategy involved a policy limit on total tax receipts at or below 23.9% of GDP. This element had been factored into budget projections since the 2014-15 Budget but was not explicitly included in the fiscal strategy until the 2018-19 Budget.17 The 23.9% tax-to-GDP limit was not a part of the fiscal strategy in the 2022-23 October Budget. Instead, the fiscal strategy was underpinned by “allowing tax receipts and income support to respond in line with changes in the economy and directing the majority of improvements in tax receipts to budget repair.”18 Figure 3-3 shows our projection for total tax receipts as a percentage of GDP across the medium term. At the end of the medium term, projected tax receipts reach, but do not exceed, the tax-to-GDP ‘cap’ of the previous fiscal strategy. Figure 3-3: Tax-to-GDP, 2022-23 to 2032-33 Note: Total receipts are comprised of tax receipts and non-tax receipts. While total receipts are projected to increase above 23.9% of GDP, tax receipts are not projected to exceed this level.

|

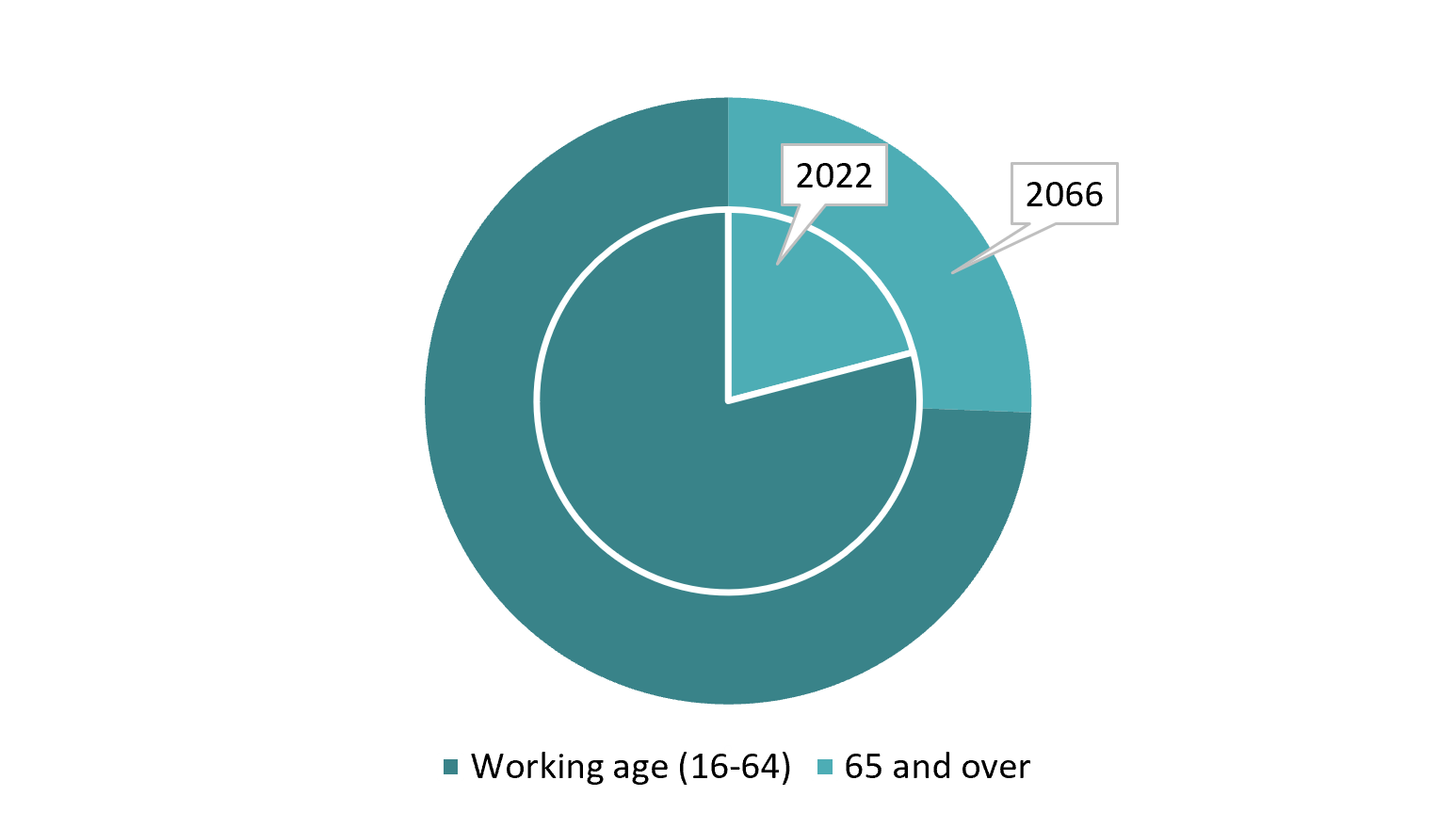

In the long term, the ageing population will have a significant impact on the budget position for 2 reasons. First, an ageing population directly increases expenditure on the aged. Expenditure on aged care services increases as more people require assistance, and expenditure on the Age pension increases as there are a greater proportion of retirees eligible. Second, an ageing population reduces the size of the labour force as a proportion of the overall population, slowing economic growth and lowering government revenue relative to the size of the economy.

The impact of the ageing population on the budget has long been recognised. It was a key focus in the first Intergenerational Report (IGR) in 2002. The most recent IGR in 2021 estimated that the ageing population would drive aged care expenditure to 2.1% of GDP by 2060-61 (equal to $113 billion in 2020-21 dollars), up from 1.2% of GDP in 2020-21.19

Significant investments into the aged-care system were made in the 2021-22 Budget, the 2022-23 March Budget, and the 2022-23 October Budget, further increasing aged-care expenditure. These were, in part, in response to the Royal Commission into Aged Care Quality and Safety (Chapter 4).

Combined with an increase in expenditure on the Age pension, the ageing population will also place downwards pressure on economic growth and government revenue. This is because, as the population ages, the size of the working-age population decreases as a share of the total population (Figure 3-4). As a result, there is a smaller pool of labour resources (relative to the population) available to produce goods and services, and growth in national income falls. In addition, the number of net taxpayers as a share of the population declines, which has a flow-on effect to government revenue, such as personal income and company taxes.20

| Figure 3-4: Working-age population compared to those aged 65 and over, 2022 and 206 |

|

Note: Population projections are the Australian Bureau of Statistics’ (ABS’) middle case. |

Source: ABS Population Projections, Australia and PBO analysis. |

The combination of increased expenditure and reduced revenue can undermine flexibility in the budget to respond to economic downturns, meaning governments would have reduced capacity to respond to adverse conditions, which may prolong the recovery. But this can also have an adverse impact on fiscal sustainability, especially if the economy is growing slower than interest payments on debt. Accordingly, Australia’s ageing population and its associated fiscal impacts will be a major factor in shaping Australia’s fiscal sustainability.

For further information on the budget impacts of the ageing population, see our Australia's ageing population report.

Climate change is expected to have wide-ranging impacts on our society, from the health of our population to the biodiversity of our ecosystems. There will also be new opportunities for investment, research, and growth in some sectors as the economy transitions to alternative sources of energy, among other things.

With the budget in deficit and elevated government debt resulting from the COVID-19 pandemic, one challenge for governments is ensuring they maintain their capacity to undertake additional public spending, both now and in the future, to address climate change. Prior to the COVID-19 pandemic, the International Monetary Fund (IMF) found that Australia had fiscal capacity to adapt to climate change.21

The climate change transition will affect the Australian Government’s finances through different pathways. Three of these pathways are infrastructure investment requirements, productivity impacts on revenue, and the budget impact of contingent liabilities that the government may take on to facilitate adaptation.

The IMF has estimated that the global direct investment required to limit warming to 1.5 degrees Celsius will be around $1,000 for each person each year until 2050.22 This is from a combination of private and government sources and is around 10 times the current level of investment for climate change.23 Given that for parts of the globe this level of annual investment is comparable with the local total GDP per capita, the required investment from high-income countries, including Australia, may well be higher.

Climate change also affects the economy and the government’s finances through reduced productivity, both directly and indirectly. Directly, there are physical effects such as an increase in the frequency and severity of adverse weather events affecting the number of working days in some industries, reducing productivity and leading to lower economic output.

Indirectly, the transition to a low-carbon economy can also affect productivity, such as the choice of policy instrument to encourage the transition to a low-carbon economy. A consistently applied carbon price across industries, for example, would have a lower impact on productivity compared to the same size but more narrowly focused policies. The lower productivity and reduced economic output would result in a lower tax receipts, affecting the government’s fiscal position. In addition, narrowly focussed policies are less likely to be resilient to a changing economy over time.

The Productivity Commission’s recent Interim report for their 5-year Productivity Inquiry included the implied costs to the economy of various emissions reduction policies.24 The implied cost of policies ranged from $12-$59 per tonne of CO2 for the Emissions Reduction Fund to upwards of $10,000 per tonne of CO2 through some of the existing electric vehicle incentives. A higher implied cost for each tonne of CO2 abatement is likely to detract more from productivity than a lower cost of abatement.

The degree to which issues or policies detract from productivity growth is important because productivity is a driver of long-term growth in living standards and it affects government finances. The 2022-23 October Budget assumed medium-term productivity growth of 1.2%. An assumption of 0.25 percentage points lower yearly productivity growth, with all else being equal, would lead to a cumulative decrease in tax revenue of around $150 billion over the next decade.

Another emerging cost of climate change in the future is contingent liabilities undertaken to assist households and communities. As natural disasters increase in frequency and severity, there will be pressure placed on the government to intervene and become the ‘insurer of last resort’ as private sector insurers retreat from high-risk areas.25 Having large contingent liabilities poses a risk to fiscal sustainability and could have the unintended consequence of limiting adaptation to climate change that would otherwise take place by individuals and businesses.

4 Revenue

- This chapter presents our projections for the individual revenue categories that determine the budget aggregates.

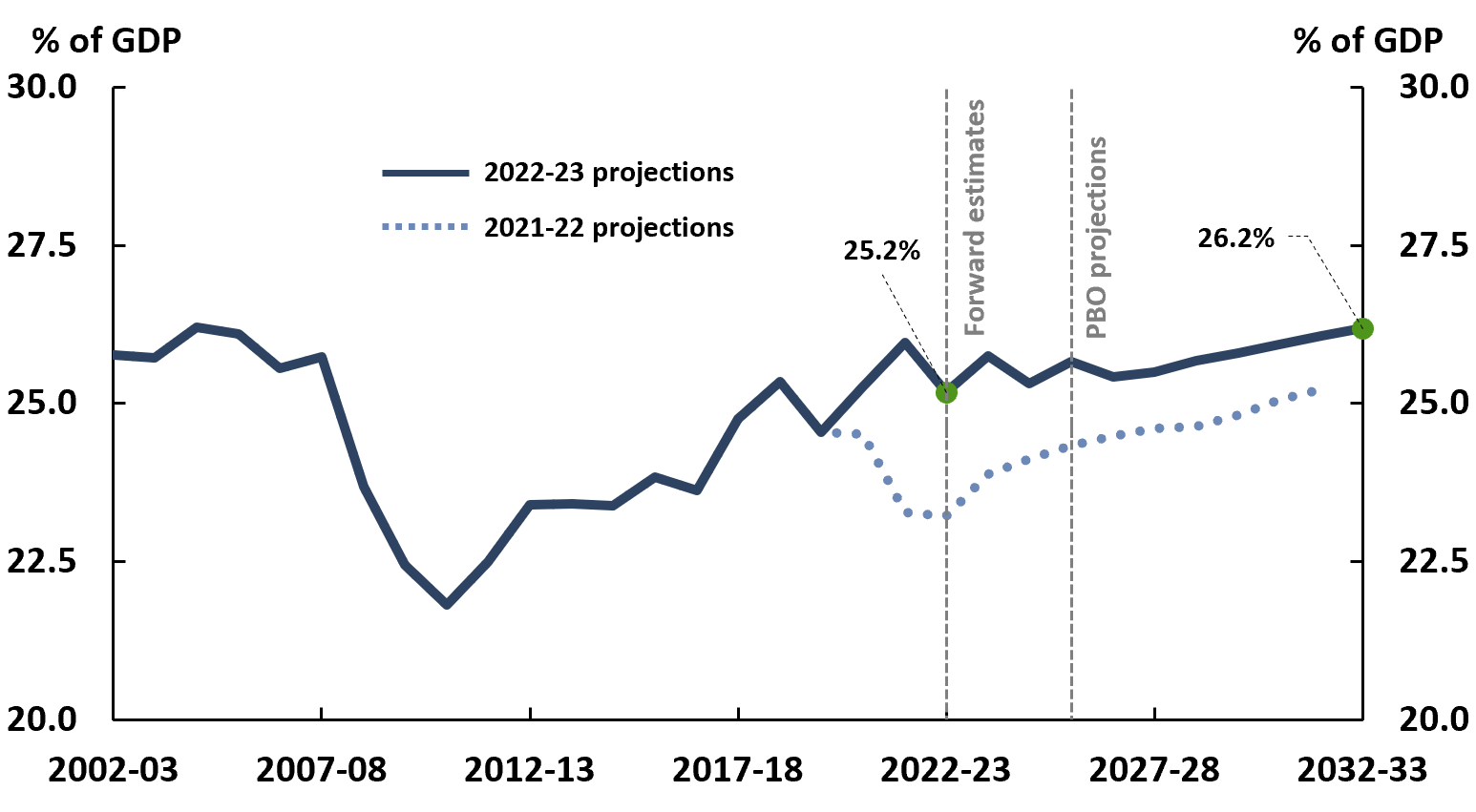

- Total revenue is projected to increase from 25.2% of GDP in 2022-23 to 26.2% of GDP in 2032-33, largely driven by personal income tax due to bracket creep and superannuation taxes due to higher employer contributions.

- Company tax revenue is projected to decrease from 5.2% of GDP in 2022-23 to 4.5% of GDP in 2032-33 as commodity prices return to trend.

- Goods and services tax (GST) revenue is projected to remain stable as a percentage of GDP across the medium term, as are most other revenue categories.

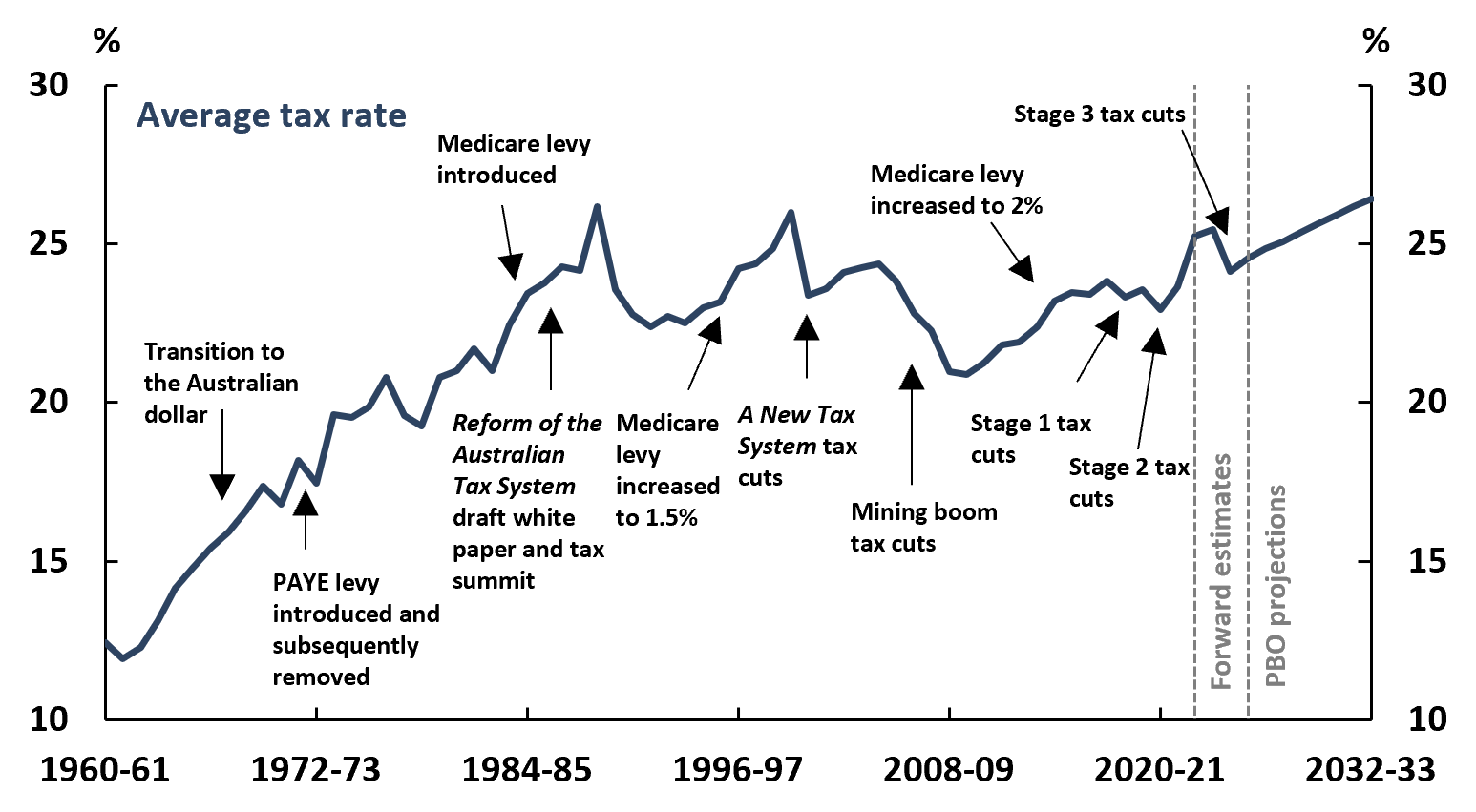

- The aggregate average personal income tax rate is projected to increase across the medium term, even after the implementation of Stage 3 of the Personal Income Tax Plan.

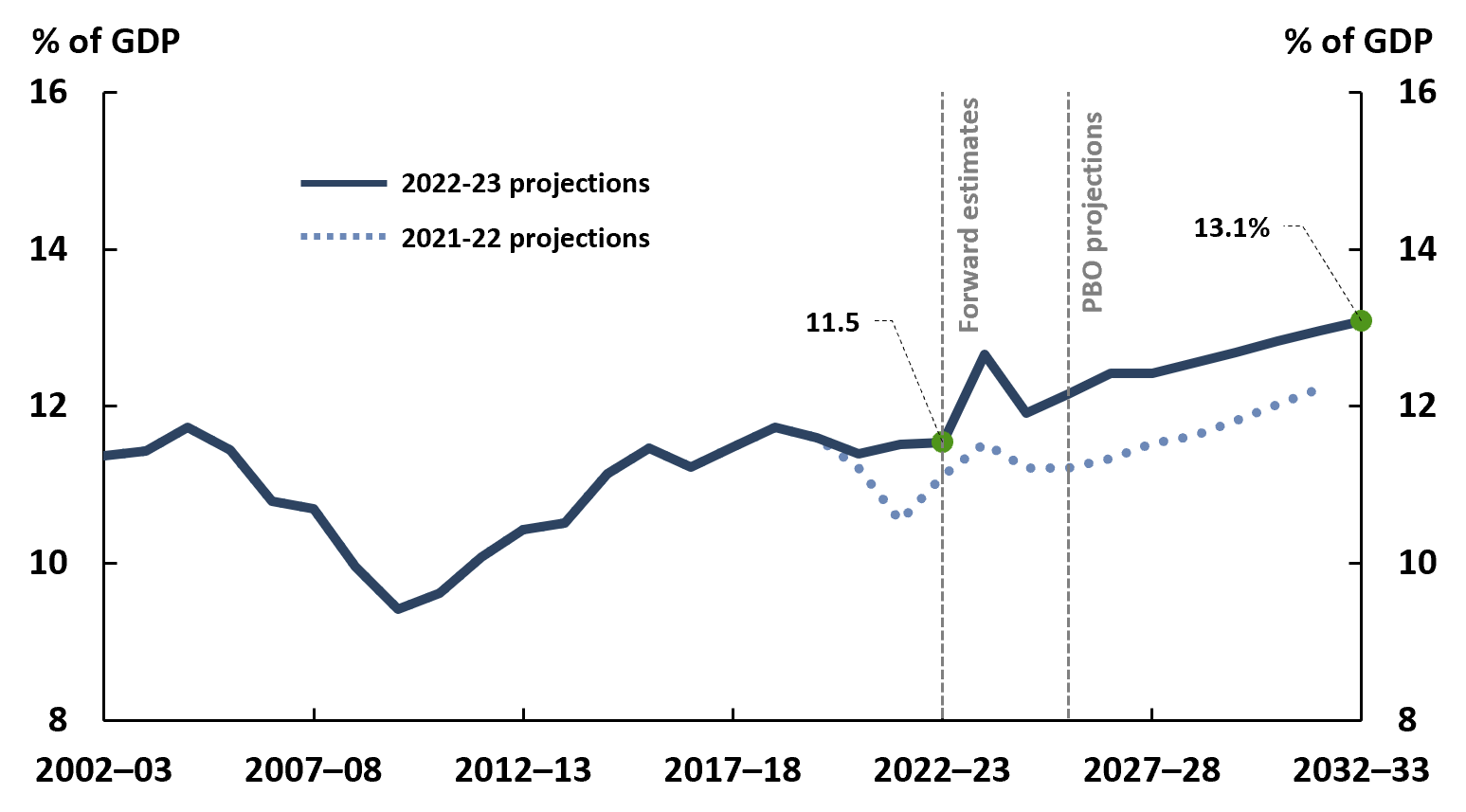

Total revenue (Figure 4-1) is projected to increase as a percentage of GDP across the medium term, reaching its highest level since 2004-05 by 2032-33. Compared to our 2021-22 projections, total revenue is projected to be higher in 2031-32, largely due to upwards revisions to personal income tax.

| Figure 4-1: Total revenue, 2002-03 to 2032-33 |

|

Source: 2022-21 Budget, 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

Personal income and superannuation taxes account for most of the increase in total revenue across the medium term, driven by nominal income growth and increases to the Superannuation Guarantee (SG) rate. As at 1 July 2022, the SG rate is 10.5% and legislated to increase by 0.5 percentage points each financial year until it reaches 12% in 2025-26.

While the increase in the SG rate leads to an increase in revenue from superannuation taxes, it has a net negative impact on total tax revenue. This is because higher employer superannuation contributions are typically borne by the employee through slower growth in salaries and wages.26 Superannuation contributions are taxed at a concessional rate (generally 15%), while salaries and wages are taxed at higher rates, on average, under the personal income tax system. For comparison, the aggregate average marginal tax rate on personal income tax is estimated to be 33.9% in 2022-23.27

Personal income tax revenue (Figure 4-2) is projected to increase as a percentage of GDP over the medium term due to bracket creep. Bracket creep occurs when average tax rates rise due to nominal income growth in a tax system with fixed thresholds (see Section 4.3).

| Figure 4-2: Personal income tax revenue, 2002-03 to 2032-33 |

|

Source: 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

The increase in personal income tax also reflects a small, positive impact from measures in the 2022-23 October Budget, which included the extension of the Australian Taxation Office’s (ATO’s) Personal Income Taxation Compliance Program. Stage 3 of the Personal Income Tax Plan, which has been factored into our projections since 2019-20, is legislated to commence in 2024-25 and estimated to decrease personal income tax revenue by 0.7% of GDP in the same year.

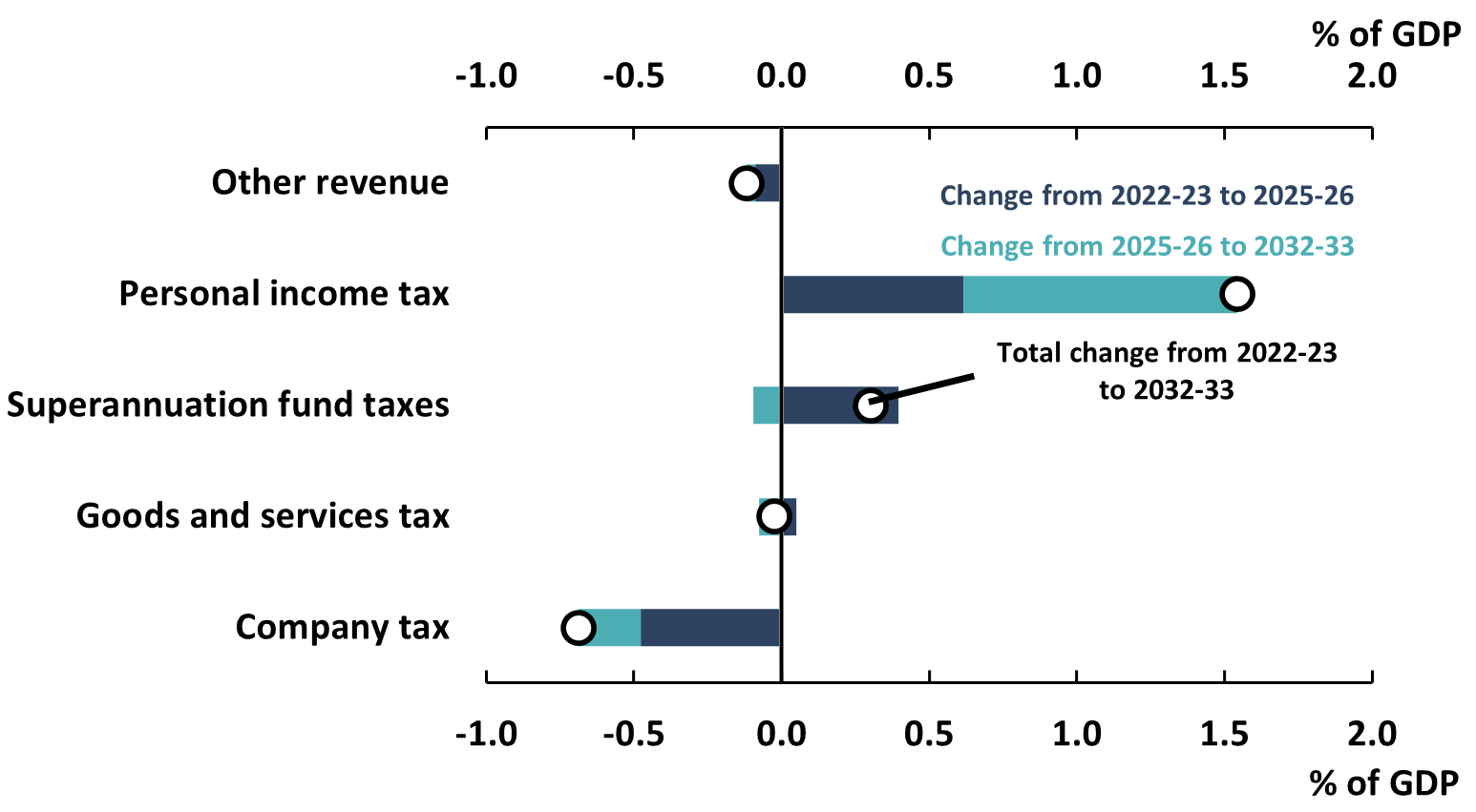

Company tax revenue is projected to decrease as a percentage of GDP between 2022-23 to 2025-26 as commodity prices return to trend. It is then projected to remain relatively flat through to 2032-33.

Goods and services tax (GST) revenue is also projected to remain relatively flat across the medium term as a percentage of GDP, as are most other revenue categories (Figure 4-3).

| Figure 4-3: Changes in tax revenue, 2022-23 to 2032-33 |

|

Source: 2022-23 October Budget and PBO analysis. |

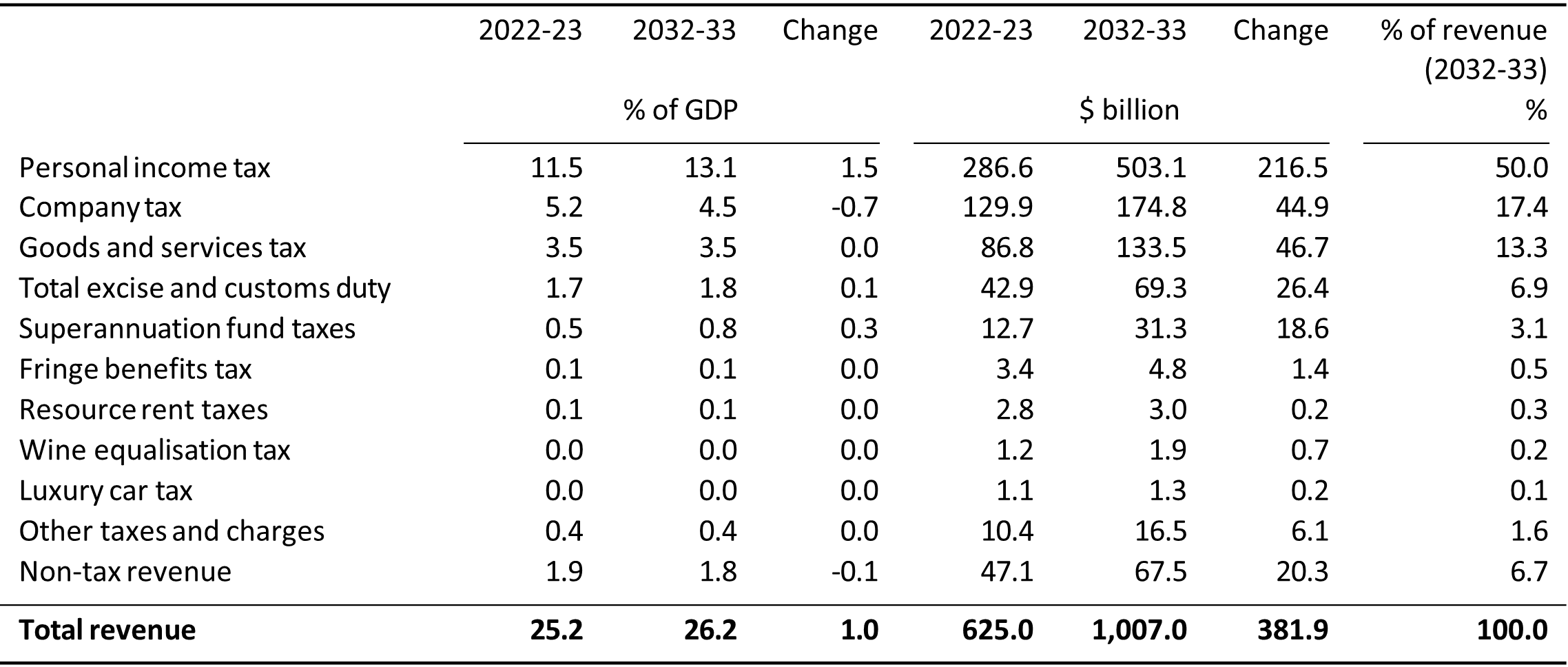

Table 4-1 illustrates the change in our projections from the initial starting point in 2022-23 to the end of the medium term in 2032-33. It highlights the significant contribution to total revenue from personal income tax which, as a percentage of GDP, contributes more than the change in total revenue, while the decline in company tax relative to GDP offsets some of this, where current levels are elevated owing to high commodity prices.

| Table 4-1: Comparison of revenue programs |

|

Note: ‘Change’ refers to the total change between 2022-23 and 2032-33. Numbers may not sum due to rounding. |

Source: 2022-23 October Budget and PBO analysis. |

Revenue measures in the 2022-23 October Budget were estimated to improve the budget position by $15.4 billion across the forward estimates.28 However, the impact of these measures across the medium term is expected to be small. For example, the extension and expansion of the ATO’s tax compliance programs, such as its Tax Avoidance Taskforce, was estimated to raise a significant amount of revenue across the forward estimates, but these programs have not been extended beyond 2025-26.

After Stage 3 of the Personal Income Tax Plan is implemented in 2024-25, the aggregate average tax rate on personal income is estimated to be 24.1%. However, over the medium term, bracket creep is projected to drive the average tax rate to 26.4% (Figure 4-4).

|

Figure 4-4: Aggregate average personal income tax rate, 1960-61 to 2032-33 |

|

Note: For consistency across time, net tax before 2000-01 is calculated before allowance for franking credits. Data for non-taxable individuals is unavailable prior to 1978-79. The net tax rate prior to 1978-79 assumes that taxable income for nontaxable individuals has the impact of reducing the average tax rate by around 0.7 percentage points, the median amount from 1978-79 to 1987-88. |

Source: ATO Taxation Statistics, 2022-23 October Budget, and PBO analysis. |

-

Bracket creep has played an important role in fiscal consolidation after major downturns in the past. For example, both the average tax rate and total tax revenue as a percentage of GDP were relatively low after the 1990s recession and the global financial crisis (GFC), but bracket creep allowed both measures to gradually increase, improving the budget position. However, too much reliance on a single revenue source can generate risks to the budget.

Higher average tax rates can magnify the economic impacts associated with personal income tax. For some people, especially those on relatively low incomes, bracket creep can reduce workforce participation. At higher incomes, bracket creep can strengthen incentives for tax planning and structuring.29

A high reliance on personal income tax can leave government revenues vulnerable to changes in the composition of the economy. For example, the ageing population is expected to result in a decline in net taxpayers as a share of the total population.30 Many retirees pay little to no personal income tax because they have lower incomes and access to age-related tax concessions.

These risks can compound over time, and future governments may face pressure to offset the impacts of bracket creep. Other than Stage 3 of the Personal Income Tax Plan, no future tax cuts are factored into the 2022-23 October Budget projections.

Accordingly, there is an important trade-off between fiscal consolidation, aided by bracket creep, and minimising the risks associated with relying on a single source of revenue. More information on how personal income tax projections compare to history can be found in our Budget bite, Trends in personal income tax.

5 Expenses

- This chapter presents our projections for the main expense categories that determine the budget aggregates.

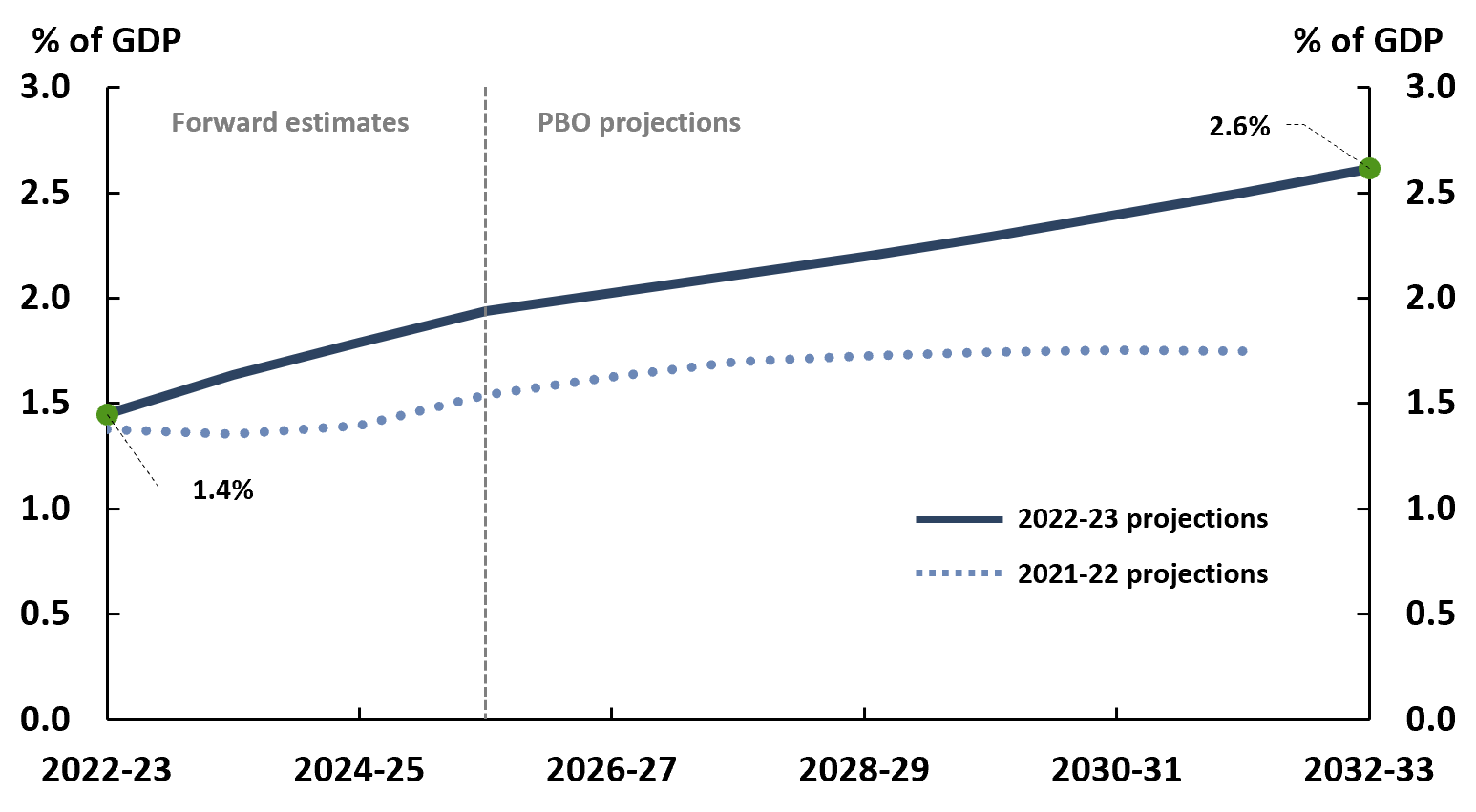

- Total expenses are projected to increase from 26.2% of GDP in 2022-23 to 27.3% of GDP in 2032-33, largely driven by expenditure on the National Disability Insurance Scheme (NDIS), interest expenses on debt, and aged care.

- Expenditure on the NDIS is projected to increase from 1.4% of GDP in 2022-23 to 2.6% of GDP in 2032-33 with more people projected to enter the scheme and average costs expected to rise.

- Interest expenses are projected to increase from 0.9% of GDP in 2022-23 to 1.7% of GDP in 2032-33, attributed to rising interest rates and increasing debt-to-GDP levels.

- Expenditure on aged care is projected to increase from 1.2% of GDP in 2022-23 to 1.4% of GDP in 2032-33, reflecting increased demand for services as the population ages as well as structural reforms to the aged care system.

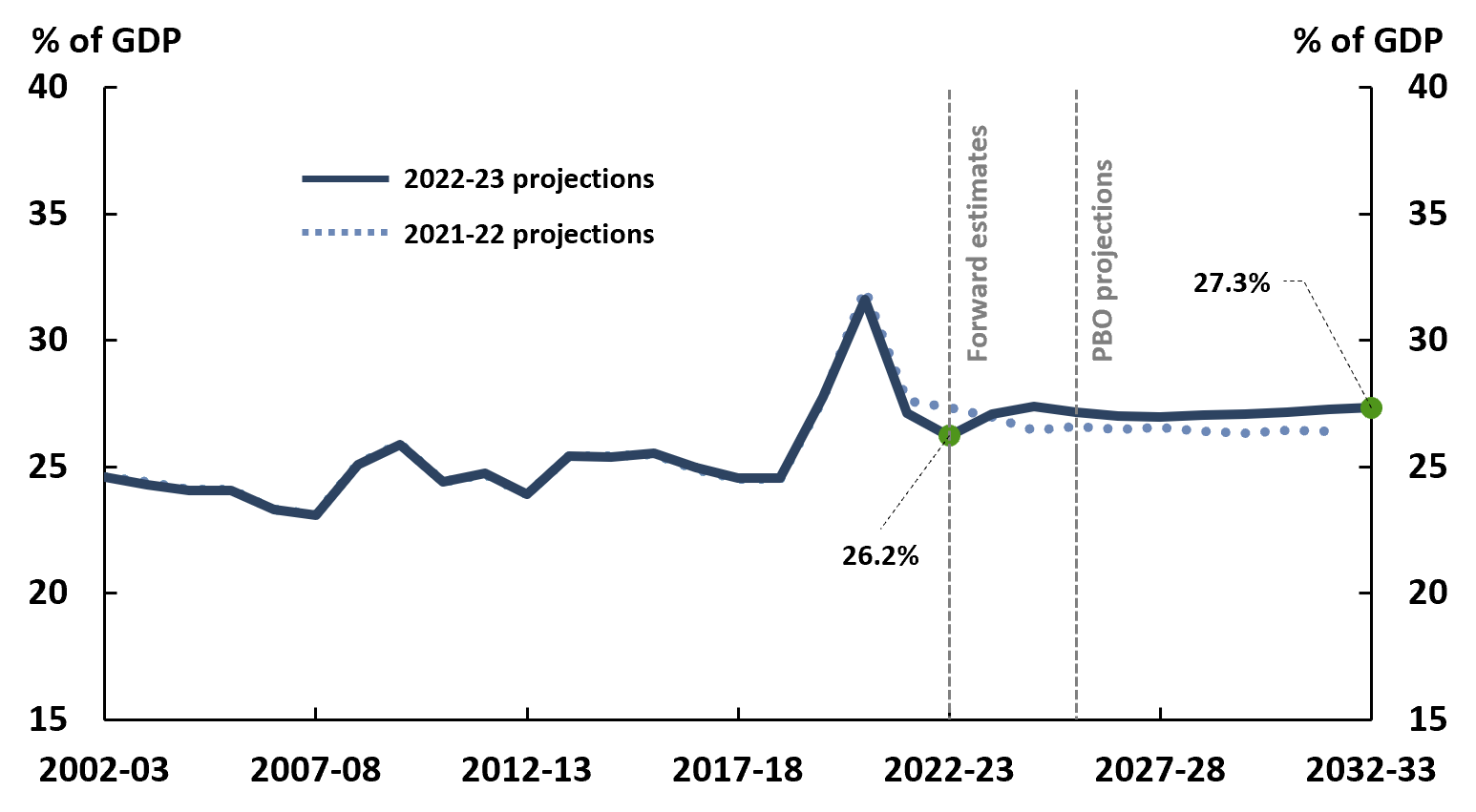

Total expenses (Figure 5-1) are projected to increase as a percentage of GDP across the medium term. Compared to our 2021-22 projections, total expenses are projected to be higher in 2031-32, largely attributed to upwards revisions to expenditure on the NDIS and interest expenses on debt.

| Figure 5-1: Total expenses, 2002-03 to 2032-33 |

|

Source: 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

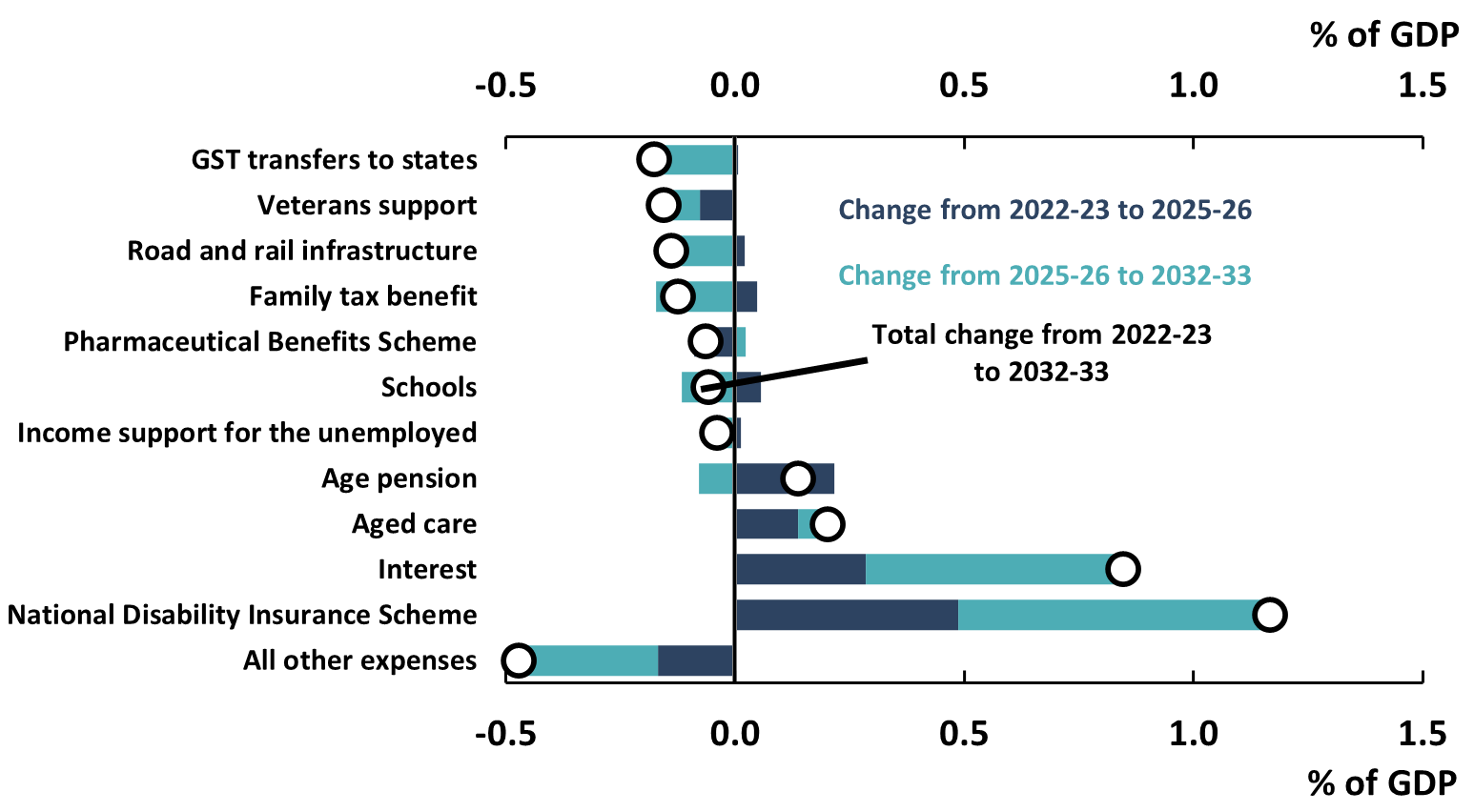

The increase in expenses across the medium term is primarily driven by expenditure on the NDIS, with more people projected to enter the scheme and average costs expected to rise (see Section 5.2). Interest expenses on debt, aged care, and Age pension expenditure are also projected to contribute to the increase (Figure 5-2).

Expenditure on GST transfers to the states and territories, veterans support, and rail and road infrastructure (as well as some other, smaller expense categories) are projected to decrease as percentage of GDP across the medium term, partially offsetting the increase.

Figure 5-2 shows the programs with the largest movements in spending as a percentage of GDP between 2022-23 and 2032-33. It shows a breakdown of the total change in expense from 2022-23 to 2032-33 shown in Figure 5-1. Table 5-1 provides a further breakdown.

| Figure 5-2: Projected change in expenses, 2022-23 to 2032-33 |

|

Source: 2020-21 Budget, 2021-22 Budget, 2022-23 October Budget, and PBO analysis. |

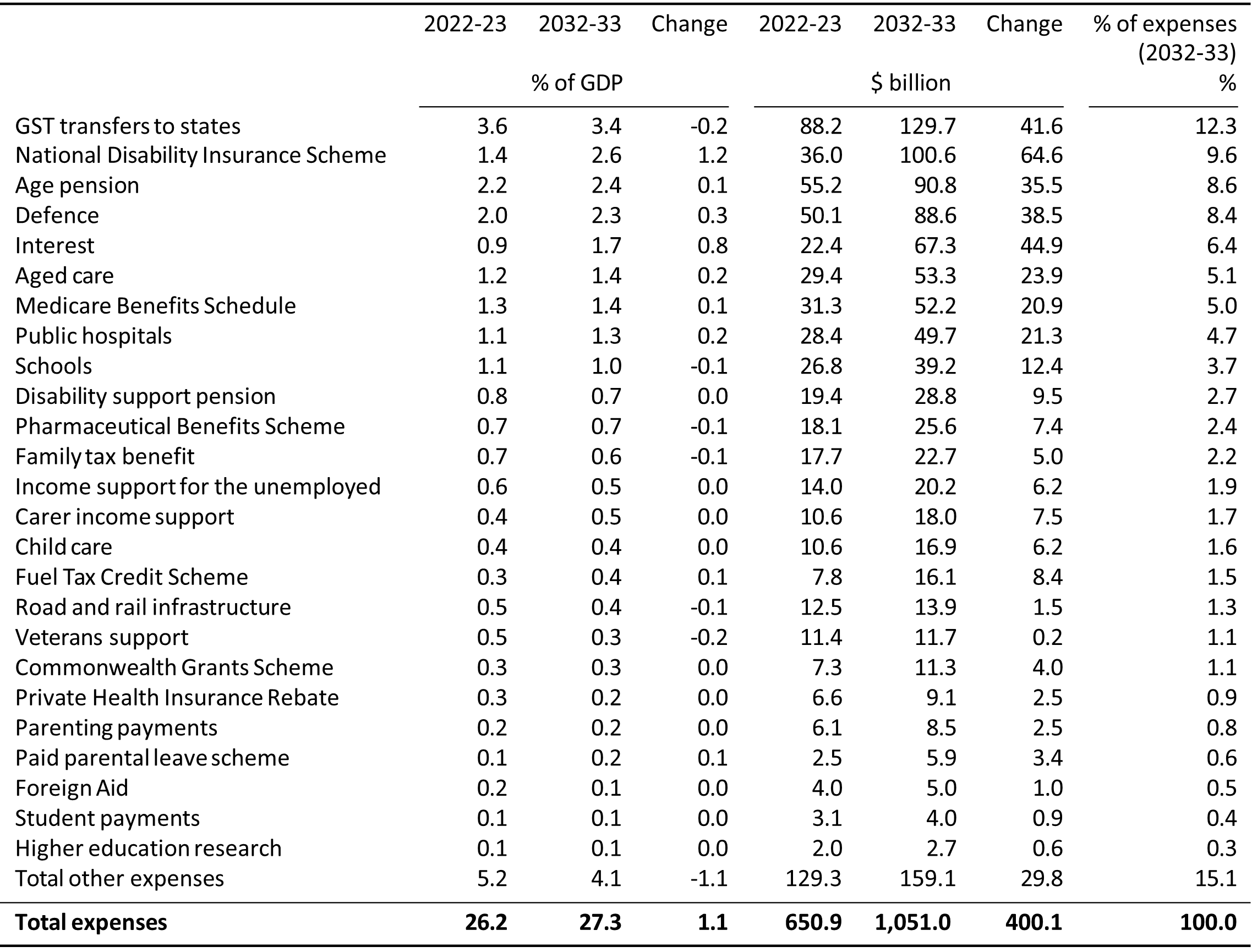

| Table 5-1: Comparison of expenses programs |

|

Note: ‘other’ expenses are all expenses not separately identified. Numbers may not sum due to rounding. |

Source: 2022-23 October Budget and PBO analysis. |

Expenditure measures in the 2022-23 October Budget were estimated to worsen the budget position by $27.8 billion across the forward estimates relative to the 2022-23 March Budget.31

Expenditure on the NDIS was revised upwards in our 2021-22 projections, reflecting both an increase in the number of people entering the scheme as well as an increase in average payments.

For the same reasons, NDIS expenditure has been revised upwards further in our 2022-23 projections (Figure 5-3), though a small proportion of the increase reflects the government’s Plan for the National Disability Insurance Scheme announced in the 2022-23 October Budget.

| Figure 5-3: NDIS expenses, 2022-23 to 2032-33 |

|

Source: 2021-2022 Budget, 2022-23 October Budget, and PBO analysis. |

The NDIS Annual Fiscal Sustainability Report for 2021-22 (2021-22 AFSR) explains that increased participants, inflation, and a higher utilisation of participant plans are the primary drivers of NDIS expenditure across the medium term.32,33

While NDIS expenses are projected to increase, there are some partially offsetting factors, related to participants with lower average payments increasing as a proportion of total participants.

The 2021-22 AFSR estimates that the change in participant composition will partially offset average payment increases in each year from 2022-23 to 2031-32.34

For instance, children (aged 0 to 14) are increasing as a proportion of total participants (from 39% at 30 September 2019 to 42% at 30 September 2022).35 Under the scheme, the average payment for children is lower than for adults. Further, individuals in supported independent living (SIL), who receive an average payment of $347,700 (at 30 September 2022) compared to the average of $40,200 for those not in SIL, are decreasing as a proportion of total participants.36

Despite these structural factors, which are expected to moderate expenditure growth, higher-than-expected inflation could increase input costs, such as equipment and remuneration of providers. There is also a risk that more participants enter the scheme than current projections, and that participant plan utilisation is higher than expected. As such, there is uncertainty around how NDIS expenditure will grow and, consequently, a risk that total expenses may be higher than projected across the medium term.

Aged care expenditure is projected to increase as a percentage of GDP across the medium term, driven by the ageing population and policy measures.

Aged care expenditure tends to increase over time because the population is ageing – that is, the number of older people is increasing faster than the number of younger people. Not only does this affect revenue, but it also affects expenses due to increased demand for government-provided aged care services.

The government has also announced significant expenditure on structural reforms to the aged care system. The 2022-23 October Budget allocated $2.5 billion over 4 years to reform the aged care system, under the Fixing the Aged Care Crisis measure. This was in addition to the $17.7 billion announced in the 2021-22 Budget in response to the Royal Commission into Aged Care Quality and Safety.

See Chapter 3 for more information on the budget impacts of the ageing population as well as our Australia’s ageing population report.

Appendix

This appendix outlines the economic context for our Beyond the budget 2022-23 and the underlying methodology.

The PBO’s projections in this report are consistent with the 2022-23 October Budget over the forward estimates period (2022-23 to 2025-26) and used as the base for our projections over the medium-term (2026-27 to 2032-33). Our medium-term projections differ from those of the budget.

Projections for revenue are generally prepared using a ‘base-plus-growth’ methodology. Economic parameters are used to estimate growth rates, which are then applied to the relevant base. Projections for expenses are prepared by multiplying the number of expected recipients by the average expense and consider a range of factors, including population growth, the age structure of the population, estimates of trends in the demand for government services, and program indexation arrangements.

Detailed revenue and expense projections in our previous Beyond the budget and medium-term projections reports were presented on a cash basis. This year’s report is presented on an accrual basis. We have adjusted our 2021-22 cash projections for comparison.

Major fiscal aggregates are still presented on both an accrual and cash basis and prepared through a balance sheet framework that uses accounting identities, consistent with last year’s report.

For further information on our balance sheet framework, see the technical appendix to our Beyond the budget 2021-22 report.

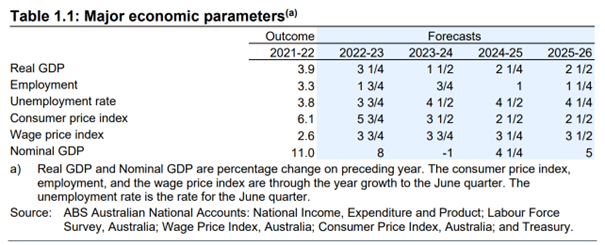

Forecasts and projections of economic parameters underpin our analysis. The key economic parameter forecasts are summarised in Budget Paper No.1 of the 2022-23 October Budget (Table 1-1).

Source: As presented in Budget Paper No.1, 2022-23 October Budget, page 6. While the budget does not include a comparison of these economic parameters with those from the previous fiscal update, our 2022-23 October Budget Snapshot, released on budget night, presents the changes.

The key changes in the economic outlook presented in the 2022-23 October Budget compared to the 2021-22 Budget (the starting point for our Beyond the budget 2021-22 report) are:

- Inflation, measured by the Consumer Price Index (CPI), is forecast to be much higher in 2022-23 and 2023-24, though it is forecast to be broadly consistent from 2024-25.

- Economic growth (both real and nominal GDP) is forecast to be higher in 2022-23 but then lower through to 2024-25.

- The unemployment rate is forecast to be lower in 2022-23 but then consistent through to 2024-25.

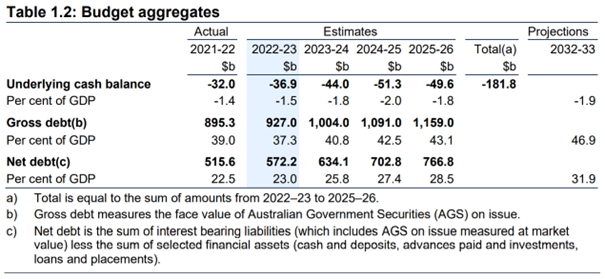

Estimates of fiscal aggregates in the forward estimates period provide the starting point for our fiscal projections across the medium and long-term periods. Estimates of key fiscal aggregates across the forward estimates are also summarised in Budget Paper No. 1 of the 2022-23 October Budget (Table 1-2).

Source: As presented in Budget Paper No.1, 2022-23 October Budget, page 6.

Changes in the budget aggregates between budgets reflect the impact of the prior year actuals as a starting point, parameter variations and policy decisions.

The final budget outcome for 2021-22 was significantly better than had been expected in the 2021-22 Budget. This has improved the starting point for the budget aggregate estimates, especially the debt path.

Economic parameter variations contributed the most to the change between budgets, compared to new policy decisions. Most of the new government’s election policy platform was included in its October budget (see Box 2-2).

The key risks to the economic outlook, as articulated in the 2022-23 October Budget, are on the downside, with uncertainty around global economic conditions flowing through to Australia. Key risks relate to the impacts of geopolitical instability, further energy price shocks, disruptions to the COVID-19 pandemic recovery path, as well as higher than anticipated inflation and interest rates. More detail on the economic outlook and the risks are in Budget Statement 2: Economic Outlook.

Accrual accounting

Accrual accounting records income when it is earned, and records costs when they are incurred, regardless of when the related cash is received or paid. Under accrual accounting, government income is called ‘revenue’ and costs are generally called ‘expenses’. As an example, under accrual accounting, goods and services tax revenue is recorded in the financial year that the goods and services are purchased, even though the government may not receive the related tax amounts until the following financial year.

Cash accounting

Cash accounting records income when cash is received, and records costs when cash is paid out, regardless of when those amounts are earned or incurred. For example, under cash accounting, goods and services tax receipts are recorded in the financial year they are received, even though those tax amounts may relate to goods and services purchased in the previous financial year. Under cash accounting, government income is called ‘receipts’ and costs are called ‘payments’.

Expenses

Expense in the budget context refers to the cost of providing government services, excluding costs related to revaluations such as the write down of assets. Examples include spending on programs such as the Age pension or Medicare, funding provided to the states and territories for public hospitals, or the wages paid to Australian Government employees.

Fiscal balance

The fiscal balance is an accrual accounting measure of the budget balance equal to the government's revenue (for example from taxes) minus its expenses (from providing services such as Medicare and income support such as the Age pension), adjusted for government capital investments such as military equipment (known as 'net capital investment in non-financial assets') when they are acquired or sold.

Fiscal sustainability

The government’s ability to maintain its long-term fiscal policy arrangements indefinitely, without the need for major remedial policy action. A fiscally sustainable position is one which can be maintained while pursuing similar borrowing and repayment approaches over the long term, such as that taxation and spending can be expected to operate within reasonable and expected bounds.

Gross debt

In the budget papers, gross debt is the sum of interest-bearing liabilities, mainly consisting of Australian Government Securities on issue, based on their value when the securities were issued (their 'face value'). Gross debt does not include any of the government’s financial assets that partly offset that debt, or any smaller debts that are not Australian Government Securities.

Headline cash balance

The headline cash balance (HCB) is a cash measure of the budget balance equal to the government's receipts (for example from tax collections) minus payments for operations and investment activities (including certain investments in financial assets). If receipts are lower than payments, the headline cash balance is in deficit, meaning the government does not have sufficient cash to cover its activities and must borrow from financial markets.

Net debt

Net debt is the sum of selected financial liabilities (deposits held, advances received, government securities, loans, and other borrowings) less the sum of selected financial assets (cash and deposits, advances paid, and investments, loans, and placements). It is a common measure of the strength of a government’s financial position. In the net debt calculation, Australian Government Securities are valued as the price they are currently trading at (their 'market value') rather than their value when the securities were issued (their 'face value').

Net financial

worth Net financial worth measures the total financial assets (such as cash or shares in a company) held by a person or organisation at a fixed point in time, minus the value of any liabilities, such as outstanding debts. Net financial worth is a broader measure of the government's financial position than net debt, but it is narrower than net worth.

Net worth

Net worth measures the government’s overall wealth, calculated as total assets (both financial and non-financial) less total liabilities. Net worth is the broadest measure of the government’s financial position.

Payments

Payments capture all outgoing cash transactions from the Australian Government to individuals, organisations, or other levels of government. In the budget context, payments are those that affect the underlying cash balance and comprise cash transactions for operating activities and the purchase of non-financial assets. Examples include an Age pension payment, a Medicare rebate for a doctor's visit, and the wages of a Centrelink employee.

Interest payments

Interest payments are the cash payments on the government’s debt liabilities which are recorded as a cost to government in the budget. Net interest payments are equal to interest payments minus the cash interest receipts earned by the government on investments in interest-bearing financial assets.

Primary cash balance

The primary cash balance adjusts the underlying cash balance to exclude interest payments on debt as well as interest receipts. As governments have little control over interest payments in the short term (interest payments are largely determined by the size of previous budget deficits), it can be useful to view this as a budget balance that is largely within the government’s control.

Receipts

Receipts are the government's income, recorded at the time they are received as reported on a cash accounting basis. In the budget context, receipts are those that affect the underlying cash balance, so exclude the repayment of loans and other cash flows relating to the exchange of financial assets. Most government receipts are tax receipts, such as company tax, personal income tax, and goods and services tax. The government also receives non-tax receipts, such as interest earned on government loans and dividends from government investments.

Revenue

Revenue is government income, recorded at the time it is earned and reported on an accrual accounting basis. Most government income is made up of tax revenue, such as company tax, personal income tax, and goods and services tax. The government also receives non‑tax revenue, such as interest earned on government loans and dividends from government investments.

Underlying cash balance

The underlying cash balance (UCB) is a cash measure of the budget balance equal to the difference between the government's receipts and its payments. It is one of several indicators known as ‘budget aggregates’ that measure the impact of the government's budget on the economy. When the government or the media say the budget is in surplus or deficit, they are generally referring to the underlying cash balance, or sometimes the net operating balance or fiscal balance. More specifically, the underlying cash balance is equal to the government's receipts (for example from tax collections) minus its payments from providing services (such as Medicare) and support (such as the Age pension). The types of receipts and payments used in the calculation include those from buying and selling non‑financial assets, such as buildings or equipment. The term 'underlying' is used because it excludes some cash transactions that are captured in the broader, but less commonly used, headline cash balance.

- Measured as the face value of Australian Government Securities (AGS) on issue at the end of the financial year (30 June).

- Generally, as interest rates rise, AGS issued in the past in a low-interest environment become less attractive to investors, decreasing their market value. Box 1 of our 2022-23 National fiscal outlook contains a more detailed explanation of the effects of interest rates on gross and net debt.

- Reserve Bank of Australia (n.d.) Cash Rate Target, RBA website, accessed 5 December 2022. Increases in the overnight cash rate since October 2022 are not factored into the 2022-23 October Budget baseline.

- Parameter variations mainly occur because of changes in the economy, such as the rate of employment or inflation. The 2022-23 October Budget noted that high commodity prices and low unemployment were the primary drivers of the upwards revision to revenue across the forward estimates. See Australian Government (2022) 2022-23 October Budget, Budget Paper No. 1, page 153, Australian Government.

- Reserve Bank of Australia (n.d.) Transmission of Monetary Policy, RBA website, accessed 2 December 2022.

- Australian Government (2022) 2022-23 October Budget, Budget Paper No. 1, page 225, Australian Government.

- Australian Government (2021) 2021-22 Budget, Budget Paper No. 1, page 216, Australian Government.

- Australian Government (2022) 2022-23 October Budget, Budget Paper No. 1, page 67, Australian Government.

- Since our 2022 ECR was published in July 2022, many of the ALP’s election commitments have been modified prior to being published in the 2022-23 October Budget (e.g., measures include changes related to the policy scope, funding profiles, presentation, parameters, and underlying assumptions). Therefore, caution should be exercised when attempting to draw conclusions from any comparisons between our 2022 ECR ALP election costings and the 2022-23 October Budget costings.

- The Hon Clare O’Neil MP (2 September 2022) Australia’s migration future, Australian Government website, accessed 28 November 2022.

- Australian Government (2022) 2022-23 October Budget, Budget Paper No. 1, page 79, Australian Government.

- Our middle case for nominal GDP growth incorporates the 2022-23 October Budget assumption for long-run productivity growth, which was revised downwards to 1.2% from 1.5% in the 2021 Intergenerational Report. This downwards revision reflects that average productivity growth over recent years has been lower than the longer-term average, but also reflects that transitioning to a low-carbon economy is likely to affect productivity growth. Our upside and downside cases have also been adjusted by a similar magnitude.

- Australian Bureau of Statistics (2018) Population Projections, Australia, ABS website, accessed 2 December 2022.

- Our cases assume each of the 3 variables that determine the debt-to-GDP ratio across the long term converge to our assumed values after 2032-33.

- Australian Government (2022) 2022-23 March Budget, Budget Paper No. 1, page 77, Australian Government.

- Australian Government (2022) 2022-23 October Budget, Paper No. 1, page 75.

- The 2017-18 Budget noted: “A tax-to-GDP ‘cap’ assumption is adopted for technical purposes and does not represent a Government policy or target” (Budget Paper No. 1, 3-16). In contrast, the 2018-19 Budget noted: “The Government will maintain, as part of its fiscal strategy, its cap on the overall tax burden, consistent with the long-term average of 23.9 per cent of GDP” (Budget Paper No. 1, 1-12).

- Australian Government (2022) 2022-23 October Budget, Paper No. 1, page 75.

- Australian Government (2021) 2021 Intergenerational Report, page 104, Australian Government. Figures are as presented in the 2021 Intergenerational Report and based on the 2021-22 Budget baseline.

- Australian Government (2021) 2021 Intergenerational Report, page 136, Australian Government.

- Aligishiev Z, Massetti E and Bellon M (23 March 2022) Macro-Fiscal Implications of Adaptation to Climate Change, International Monetary Fund, accessed 22 November 2022.

- Figures are in Australian Dollar terms.

- Based on Georgieva K and Adrian T (18 August 2022) Public Sector Must Play Major Role in Catalyzing Private Climate Finance, International Monetary Fund, accessed 22 November 2022. Calculations included PBO analysis.

- Productivity Commission (5 September 2022) 5-year Productivity Inquiry: A competitive, dynamic and sustainable future Interim report, Australian Government, accessed 23 November 2022.

- The Northern Australia Reinsurance Pool is an example of a government intervention in this space.

- Grattan Institute (2020) No free lunch: higher super means lower wages, page 3, Grattan Institute.

- The aggregate average marginal tax rate is calculated as the average tax that would be paid on an additional $1 of income for the entire taxpayer population, weighted by taxable income.

- Australian Government (2022) 2022-23 October Budget, Budget Paper No. 1, page 165, Australian Government.

- Australian Government (2015) Re:think Tax discussion paper, page 23, Australian Government.

- Australian Government (2021) 2021 Intergenerational Report, page 136, Australian Government.

- Australian Government (2022) 2022-23 October Budget, Budget Paper No. 1, page 176, Australian Government.

- National Disability Insurance Scheme (NDIS) (2022) Annual Financial Sustainability Report 2021-22, page 76, NDIS.

- National Disability Insurance Scheme (NDIS) (2022) Annual Financial Sustainability Report 2021-22, page 98, NDIS.

- National Disability Insurance Scheme (NDIS) (2022) Annual Financial Sustainability Report 2021-22, page 97, NDIS.

- National Disability Insurance Agency (NDIA) (September 2022) NDIS Quarterly Report to disability ministers, page 114, NDIA.

- National Disability Insurance Agency (NDIA) (September 2022) NDIS Quarterly Report to disability ministers, page 114, NDIA.

Fiscal sustainability dashboard

Interactive fiscal sustainability dashboard provides trajectories for gross debt using selected scenarios of key variables.

Explains key terms related to the Commonwealth Government budget in a non-technical way.