Overview

With all state and territory 2024-25 Budgets now released, the Parliamentary Budget Office (PBO) has consolidated the forecasts from these budgets with the Australian Government’s budget – released in May 2024 – to provide an aggregated outlook for the national fiscal position.

Since our last report in October 2023, the national fiscal outlook has improved, driven by a better Commonwealth budget position bolstered by elevated commodity prices and a strong labour market. The fiscal position has worsened across states and territories (states) despite improved forecast revenue in every state, as expenses for cost-of-living relief and health measures are expected to increase. Nevertheless, the total state net operating balance is expected to be in surplus from 2025-26, consistent with our previous report.

Stronger Commonwealth budget balances have reduced national net debt compared to the 2023-24 National Fiscal Outlook (NFO), but public debt interest payments have increased, reflecting tight monetary policy settings. Per capita net debt continues to increase, with national net capital investment per capita having peaked in 2022-23.

The PBO’s dynamic analysis shows an even stronger long-term fiscal sustainability outlook compared to last year’s report. In all but 2 scenarios, the debt-to-GDP ratio is expected to trend downwards over the 40-year period. This suggests the national fiscal position is likely to remain sustainable, providing sufficient fiscal space to address key risks, all other things being equal.1

Trends in the budget aggregates2

Compared to the 2023‑24 NFO, all the main budget aggregates, except for public debt interest payments, have improved as a share of GDP at the national level. This reflects the better Commonwealth position, partially offset by a general deterioration in the aggregates across states.

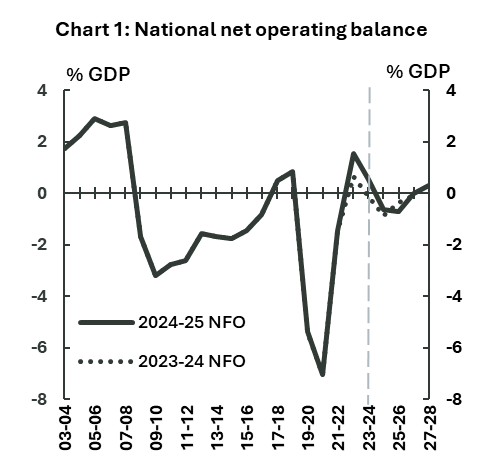

Forecast national net operating balance – the difference between revenue and expenses – has increased over the forward estimates and is expected to return to surplus by 2027‑28 (Chart 1). The Commonwealth (accounting for around three-quarters of national revenue and expenses) is driving the results. Total state revenue is higher than previously forecast, supported by strong payroll tax, property tax, and royalties. This is expected to be outpaced by growth in expenses due to increased spending on cost of-living relief and health measures.

The Goods and Services Tax (GST) and related payments contribute around a quarter of total state revenue. This includes the temporary ‘no-worse off’ (NoWO) payment3 from the Commonwealth of around $20.4 billion4 (or 5% of the GST pool) across the forward estimates. The NoWO has been extended for 3 years until 2029‑30.

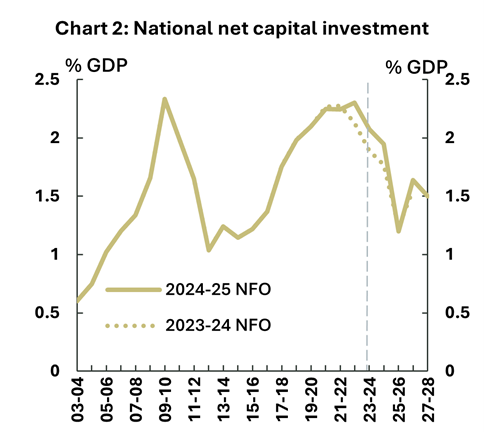

National net capital investment5 – spending on infrastructure such as roads, schools, and hospitals – declines as a share of GDP over the forward estimates, but at a less steep rate than in the 2023‑24 NFO (Chart 2). This reflects significant upward revisions in infrastructure investment in Queensland and the Northern Territory, and project reprofiling in South Australia. Estimates for the Commonwealth have not significantly changed.

National net capital investment5 – spending on infrastructure such as roads, schools, and hospitals – declines as a share of GDP over the forward estimates, but at a less steep rate than in the 2023‑24 NFO (Chart 2). This reflects significant upward revisions in infrastructure investment in Queensland and the Northern Territory, and project reprofiling in South Australia. Estimates for the Commonwealth have not significantly changed.

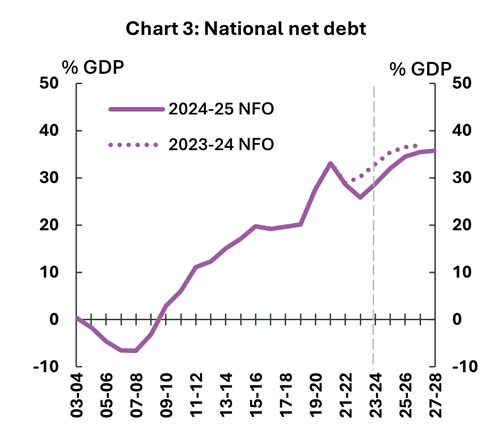

Forecast national net debt has improved compared to the 2023‑24 NFO but remains on an upwards trajectory. It is estimated to reach 36% of GDP by 2027‑28 (Chart 3). Commonwealth net debt as a share of GDP is expected to remain below its 2020‑21 peak reflecting improved projected budget balances. Forecast national public debt interest payments have been revised up from $48.1 billion by $4.5 billion for 2026‑27, to $52.6 billion.

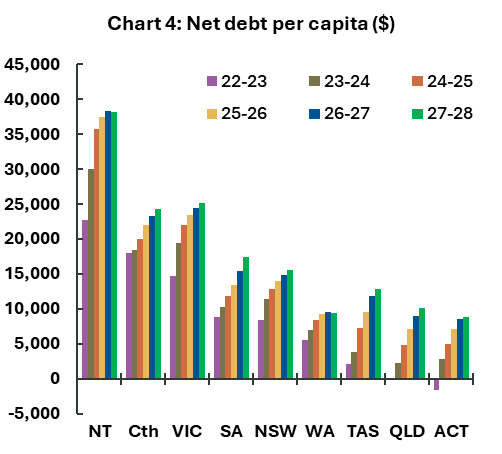

Net debt in most jurisdictions remains at record high levels over the forward estimates. On a per capita basis, NT continues to have the highest net debt, however, along with WA, it is the only jurisdiction to forecast a decline in net debt in 2027‑28 (Chart 4).

Net debt in most jurisdictions remains at record high levels over the forward estimates. On a per capita basis, NT continues to have the highest net debt, however, along with WA, it is the only jurisdiction to forecast a decline in net debt in 2027‑28 (Chart 4).

Despite the estimated increases in net debt, the PBO’s fiscal sustainability analysis shows in most scenarios, the debt-to-GDP ratio is expected to trend downwards over the long term (Box 1).

National fiscal sustainability over the long term

The PBO has applied its fiscal sustainability framework to analyse governments’ ability to maintain long-term fiscal policy settings indefinitely, without the need for major remedial policy interventions. If debt-to-GDP is declining, it is more likely to be sustainable.

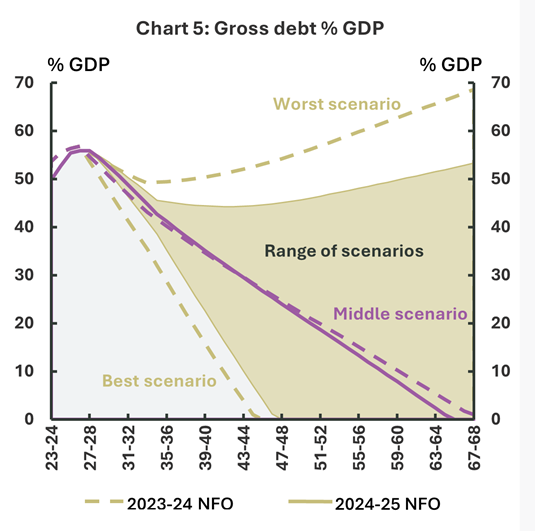

In our fiscal sustainability analysis , we examine 27 scenarios for the consolidated national debt to-GDP ratio over a 40-year period. Each scenario reflects the range of historical outcomes to project upper, middle, and lower variations from 2027-28. Variations are made to the consolidated national budget balance (headline cash balance before interest payments), the prior stock of debt and the interest rates that apply to this debt, and economic growth (nominal GDP). The results are shown in the shaded area of Chart 5.

Because each scenario is based on the range of historical outcomes, they implicitly allow for changes in economic conditions, including downturns, and the flexibility for governments to respond, either through automatic or discretionary mechanisms. No specific scenario should be considered as a baseline or most likely trajectory. Instead, we are illustrating what the path could be under a range of economic and policy conditions which are broadly consistent with historical fluctuations. For further methodological details and analysis, please see our Technical Appendix.

This year’s analysis shows a stronger long-term sustainability outlook, with the consolidated national debt-to-GDP ratio expected to trend downwards, suggesting likely sustainable fiscal positions in all but 2 scenarios (Chart 5). The debt-to-GDP ratio at the end of the 40-year period in the worst scenario is also projected to be 15 percentage points lower than projected in the 2023‑24 NFO.

In our middle scenario, the debt-to-GDP ratio is projected to trend downwards across the scenario period to reach nil in 2065-66. In our best scenario, the debt-to-GDP ratio trends sharply downwards and reaches nil by 2047‑48, 2 years later than previously projected.

Our interactive dashboards are best viewed on larger screens/desktops.

Interactive analysis

The below complementary set of interactive charts provides a graphical summary of Commonwealth, state and territory budgets. Change the aggregates, units and budget data source to create customised visualisations.

For further insights, see our Fast Facts.

Click here to view the dashboard in the web browser.

Our interactive dashboards are best viewed on larger screens/desktops.

Fast Facts

- National fiscal balance is forecast to improve from a deficit of 2.6% of GDP ($71.7 billion) in 2024‑25 to a deficit of 1.2% of GDP ($38.1 billion) in 2027‑28. Compared to our previous NFO, the forecast national fiscal balance has been revised up by $10.2 billion for 2023‑24 and revised down by $2.3 billion for 2026‑27.

- National net operating balance is forecast to improve from a deficit of 0.7% of GDP in 2024‑25 ($18.0 billion) to a surplus of 0.3% of GDP 2027‑28 ($9.6 billion). Compared to our previous NFO, forecast national net operating balance has been revised up by $17.3 billion for 2023‑24 and $1.8 billion for 2026‑27.

- National revenue is forecast to fall from 35.7% of GDP ($985.5 billion) in 2024‑25 to 35.0% of GDP ($1,114.1 billion) in 2027‑28. Compared to our previous NFO, forecast national revenue has improved, being revised up by $40.6 billion for 2023‑24 and $42.8 billion for 2026‑27.

- National expenses are forecast to fall from 36.4% of GDP ($1,003.4 billion) in 2024‑25 to 34.7% of GDP ($1,104.5 billion) in 2027‑28. Compared to our previous NFO, forecast national expenses have increased, being revised up by $23.3 billion for 2023‑24 and $41.0 billion for 2026‑27.

- National net debt is forecast to increase from 32.0% of GDP ($881.9 billion) in 2024‑25 to 35.7% of GDP ($1,136.3 billion) in 2027‑28. Compared to our previous NFO, forecast national net debt has improved, being revised down by $78.5 billion for 2023‑24 and $6.8 billion for 2026‑27.

- National net financial worth is forecast to fall from -32.7% of GDP (-$901.5 billion) in 2024‑25 to -34.7% of GDP ($1,104.6 billion) in 2027‑28. Compared to our previous NFO, forecast national net financial worth has improved, being revised up by $103.8 billion for 2023‑24 and $46.6 billion for 2026‑27.

- National net capital investment is forecast to fall from 1.9% of GDP ($53.7 billion) in 2024‑25 to 1.5% of GDP ($47.8 billion) in 2027‑28. Compared to our previous NFO, forecast national net capital investment has increased, being revised up by $7.1 billion for 2023‑24 and $4.1 billion for 2026‑27.

- National public debt interest payments are forecast to increase from 1.5% of GDP ($41.2 billion) in 2024‑25 to 1.9% of GDP ($61.3 billion) in 2027‑28. Compared to our previous NFO, forecast national public debt interest payments have been revised up by $1.8 billion for 2023‑24 and $4.5 billion for 2026‑27.

- State fiscal balance is forecast to improve from a deficit of 1.6% of GDP ($44.0 billion) in 2024‑25 to a deficit of 0.6% of GDP ($18.0 billion) in 2027‑28. Compared to our previous NFO, the forecast state fiscal balance was revised down by $10.8 billion for 2023‑24 and $7.1 billion for 2026‑27.

- State net operating balance is forecast to improve from a deficit of 0.3% of GDP ($7.7 billion) in 2024‑25 to a surplus of 0.2% of GDP ($5.4 billion) in 2027‑28. Compared to our previous NFO, the forecast state net operating balance has declined, being revised down by $1.9 billion for 2023‑24 and $3.9 billion for 2026‑27.

- State revenue is forecast to fall from 14.9% of GDP ($411.7 billion) in 2024‑25 to 14.0% of GDP ($444.2 billion) in 2027‑28. Compared to our previous NFO, forecast state revenue has improved, being revised up by $10.3 billion in 2023‑24 and $18.7 billion in 2026‑27.

- State expenses are forecast to fall from 15.2% of GDP ($419.4 billion) in 2024‑25 to 13.8% of GDP ($438.9 billion) in 2027‑28. Compared to our previous NFO, forecast state expenses have increased, being revised up by $12.3 billion in 2023‑24 and by $22.5 billion in 2026‑27.

- State net debt is forecast to increase from 13% of GDP ($357.5 billion) in 2024‑25 to 14.8% of GDP ($471.9 billion) in 2027‑28. Compared to our previous NFO, forecast state net debt was mixed, being revised down by $2.2 billion in 2023‑24 and revised up by $38.2 billion in 2026‑27.

- State net financial worth is forecast to fall from -6.1% of GDP ($167.2 billion) in 2024‑25 to -7.9% of GDP ($250.6 billion) in 2027‑28. Compared to our previous NFO, forecast state net financial worth was mixed, being revised up by $49.7 billion for 2023‑24 and revised down by $2.2 billion for 2026‑27.

- State net capital investment is forecast to fall from 1.3% of GDP ($36.3 billion) in 2024‑25 to 0.7% of GDP ($23.3 billion) in 2027‑28. Compared to our previous NFO, forecast state net capital investment has increased, being revised up by $8.9 billion for 2023‑24 and $3.3 billion for 2026‑27.

- State public debt interest payments are forecast to increase from 0.6% of GDP ($17.3 billion) in 2024‑25 to 0.8% of GDP ($25.7 billion) in 2027‑28. Compared to our previous NFO, forecast state public debt interest payments have been revised up by $0.2 billion for 2023‑24 and $1.8 billion for 2026‑27.

Footnotes

The contents of this report are the sole responsibility of the Parliamentary Budget Office.

1 More discussion on Commonwealth fiscal sustainability and risks is contained in Beyond the budget 2024-25.

2 Forecasts for GDP have been revised up across the forward estimates when compared to the 2023-24 NFO. Consequently, an unchanged or slightly higher dollar amount will appear as a smaller proportion of GDP.

3 When the new GST distribution system was introduced in 2018, a legislated ‘no-worse off’ payment was included to ensure no state was worse-off than under the previous system. The payment was set to expire in 2027-28. In December 2023, the Government announced the payment would be extended to the end of 2029-30. See Commonwealth Grants Commission 2024, GST Revenue Sharing Relativities 2024.

4 Commonwealth Budget 2024-25, Budget Paper No. 3: Federal Financial Relations, Table 3.1 and PBO calculations.

5 Net capital investment measures the change in non‑financial assets (such as infrastructure, land or equipment) over a period of time. See the PBO’s online glossary for further definitions of budget terms. National net capital investment excludes government business, as forecasts are not available beyond the budget year.

The technical appendix and data pack provides further information on the data sources and method used in this report.

Additional data to those cited in this report is available on our data portal.